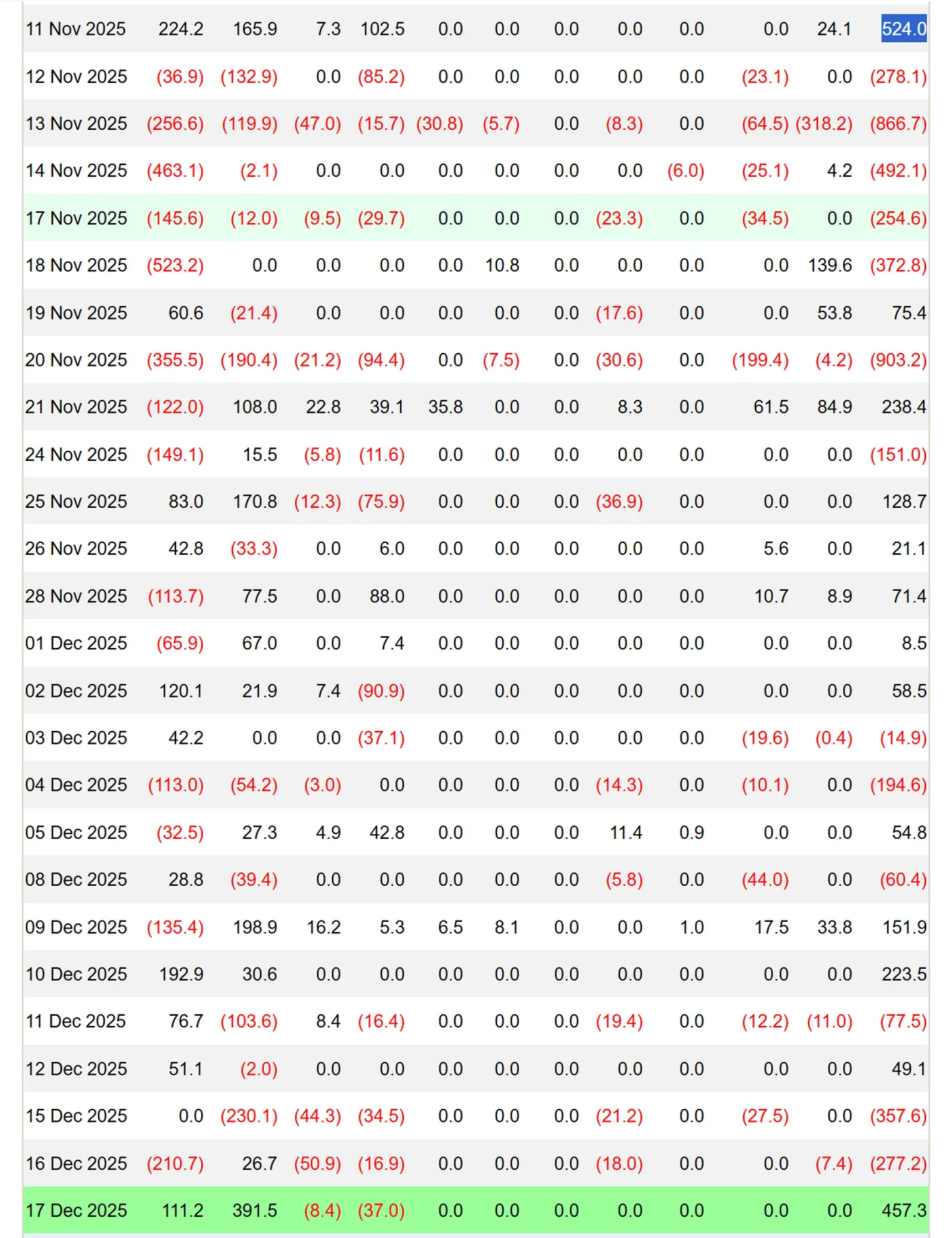

Spot Bitcoin ETFs recorded a significant one-day capital inflow: net inflows reached $457 million, marking the largest single-day volume in over a month. The majority of this inflow was driven by two funds: Fidelity’s Wise Origin Bitcoin Fund (FBTC) with approximately $391 million and BlackRock’s iShares Bitcoin Trust (IBIT) with around $111 million, according to Farside Investors.

Record Inflows into Spot Bitcoin ETFs

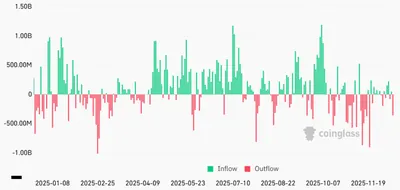

The one-day net inflows of $457 million pushed the total net inflows for U.S. spot Bitcoin ETFs above $57 billion, while the funds’ total assets exceeded $112 billion. The market had shown alternating modest inflows and sharp outflows in recent weeks, and the recent surge was the largest in some time.

Experts’ Views on the Current Situation

Vincent Liu, Chief Investment Officer at Kronos Research, characterized the recent inflow surge as "early positioning," noting that the interest appears driven by changes in rate expectations rather than late-cycle enthusiasm. He also emphasized that capital flow depends on liquidity and price movements, so the dynamics may be uneven.

Policy Impact on the Cryptocurrency Market

In a public speech, U.S. President Donald Trump announced plans to appoint a new Federal Reserve Chair who supports lowering interest rates. The speech also mentioned that lower rates are generally seen as positive for risk assets, including cryptocurrencies, and political signals shape the overall market sentiment.

Current State of the Bitcoin Market

According to Glassnode data, the number of bitcoins held at a loss has reached 6.7 million BTC—the highest in the current cycle. Meanwhile, demand on both sides of the market remains fragile: selective spot purchases and occasional corporate transactions have not restored sustained confidence, and futures positions generally lean towards risk reduction.

Why This Matters

For a miner operating 1–1000 devices in Russia, three aspects of this news are important: first, significant institutional inflows reflect major investors’ interest in spot ETFs, which can affect market volatility and short-term liquidity. Second, political statements on rates create a backdrop that institutions consider when reallocating capital. Third, the high volume of bitcoins held at a loss indicates ongoing uncertainty in seller and buyer behavior.

What to Do?

If you mine in Russia and manage a farm of a hundred or fewer machines, focus on cost control and operational flexibility. In conditions of unstable inflows and volatile liquidity, key tasks remain expense optimization and sales planning.

- Check your mining cost and compare it with current BTC prices—this will help decide the advisability of short-term sales.

- Keep part of the mined coins in reserve to smooth out short-term price fluctuations and avoid selling during local volatility spikes.

- Monitor news on ETFs and macro factors—large inflows or outflows can make the market more volatile, affecting timing and volume of sales.

- Plan maintenance and energy consumption to be able to quickly adjust load when tariffs or electricity prices change.

If you want to track recent ETF inflow and outflow dynamics over the past days, check related materials on fund flows: $358M outflow from Bitcoin ETF and an article on a recent outflow led by Fidelity — spot Bitcoin ETFs recorded $351.7M outflow. These resources help illustrate how quickly inflow and outflow patterns change.

Brief Facts

Key figures to remember: a one-day inflow of $457 million, leaders in capital attraction—FBTC and IBIT with approximately $391 million and $111 million respectively, cumulative net inflows above $57 billion, and total fund assets exceeding $112 billion. Also important is that 6.7 million BTC are held at a loss, reflecting current structural tension in the market.