The New York Stock Exchange (NYSE) has been playing an increasingly important role in the cryptocurrency market by facilitating the public listings of crypto-related companies. This involvement marks a significant step in integrating cryptocurrencies into traditional financial markets, offering these companies greater visibility and access to capital.

Overview of NYSE's Role in Cryptocurrency Market

The NYSE's engagement with cryptocurrency firms reflects a growing acceptance of digital assets within established financial institutions. By providing a platform for crypto companies to go public, the NYSE helps legitimize the sector and opens new avenues for investment. Public listings are particularly significant as they enable these companies to raise funds from a broader investor base while increasing transparency and regulatory oversight.

Expansion of Cryptocurrency Public Listings on NYSE

Recently, there has been a noticeable increase in the number of cryptocurrency-related companies choosing to list on the NYSE. This expansion encompasses a diverse range of firms, including those involved in crypto mining, blockchain technology development, and digital asset management. The variety of listed companies highlights the sector's maturation and the NYSE's commitment to supporting its growth.

Impact on Mainstream Capital and Market Adoption

NYSE listings facilitate access to mainstream capital by connecting crypto companies with traditional investors who may have been previously hesitant to enter the market. This increased participation helps build investor confidence, which in turn supports market growth and stability. As more crypto firms become publicly traded, the market benefits from enhanced liquidity and greater integration with conventional financial systems.

For example, the expansion of institutional crypto infrastructure, as seen with collaborations like Standard Chartered and Coinbase, complements the NYSE's efforts by providing robust frameworks for investment and trading.

Future Outlook for Cryptocurrency Listings on NYSE

Looking ahead, the trend of increasing cryptocurrency public listings on the NYSE is expected to continue. This growth may lead to broader acceptance of digital assets and further innovation within the crypto ecosystem. The presence of diverse crypto companies on a major exchange like the NYSE signals a positive direction for mainstream adoption and could pave the way for new financial products and services.

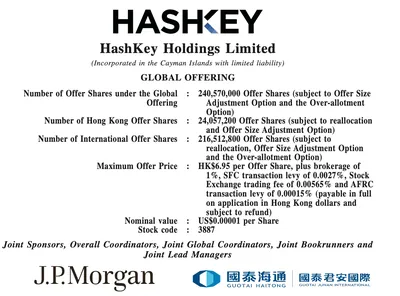

Additionally, developments such as the HashKey IPO in Hong Kong and new financial instruments like the Bitwise HYPE Spot ETF indicate a global momentum towards integrating crypto assets with traditional markets.

Why This Matters

For miners operating in Russia with up to 1,000 devices, the NYSE's expanding crypto listings may not directly change daily operations but represent a broader legitimization of the industry. Increased public listings can lead to more investment in infrastructure and technology, potentially improving market stability and liquidity. This environment benefits miners by fostering a healthier ecosystem and possibly influencing regulatory frameworks.

What To Do

- Stay informed about new public listings and market developments on the NYSE to understand how they might affect crypto asset valuations.

- Consider the impact of increased institutional involvement on market dynamics when planning mining operations or asset management.

- Monitor related infrastructure advancements, such as institutional partnerships and new financial products, which can influence market access and liquidity.