HashKey is preparing to make history by launching Hong Kong’s first fully crypto-native initial public offering (IPO), aiming to list 240.57 million shares under the city’s virtual asset regulatory framework. This move not only highlights HashKey’s ambitions but also puts Hong Kong’s evolving approach to digital asset regulation in the spotlight, testing whether a compliance-focused crypto platform can attract public investors.

Overview of HashKey's IPO

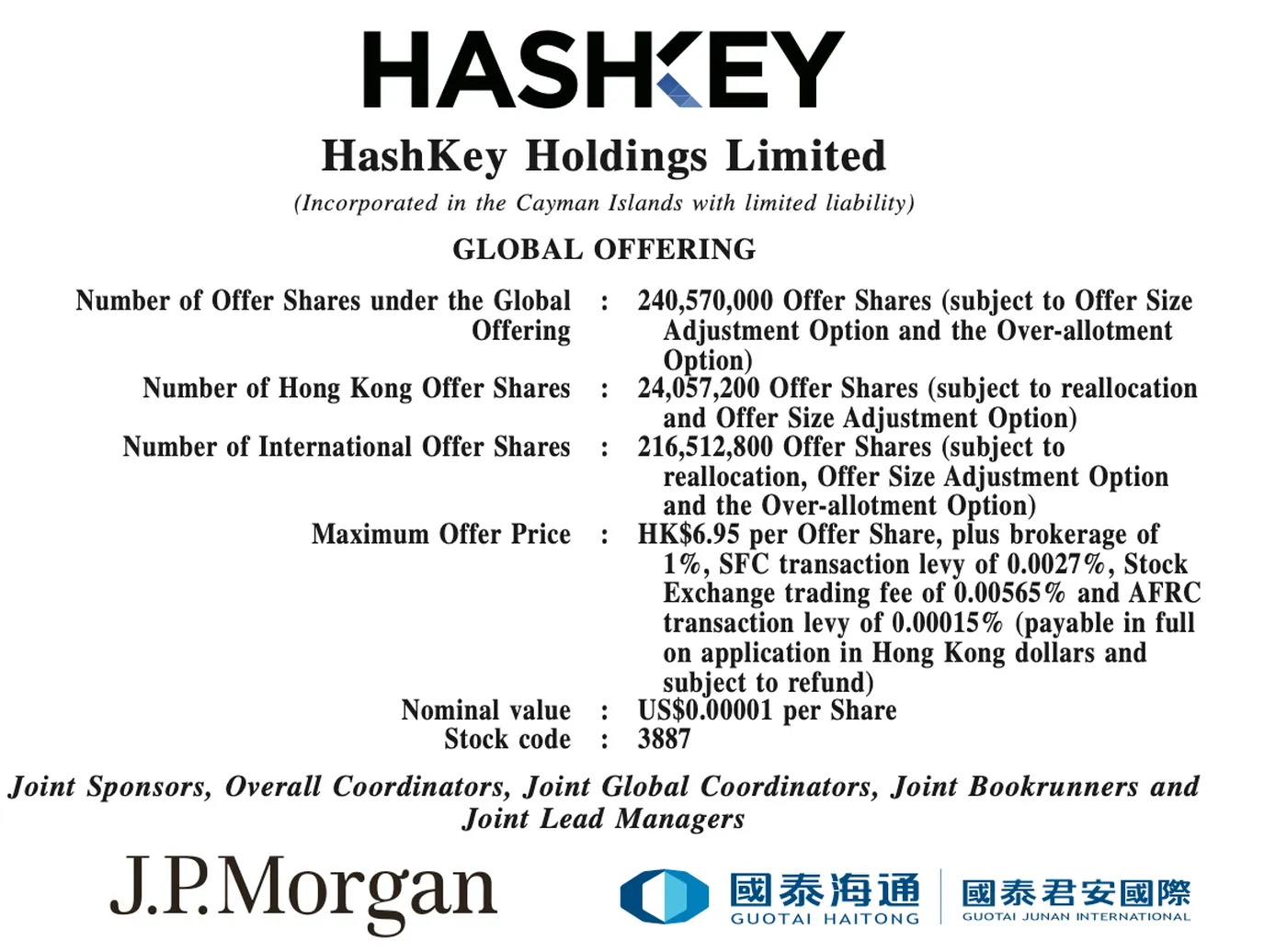

The upcoming IPO will see HashKey offering 240.57 million shares, with a portion reserved for local retail investors and the rest available to international buyers. Shares are being marketed within a price range of 5.95 to 6.95 Hong Kong dollars, which could raise as much as 1.67 billion HKD, or about $215 million, if fully subscribed. Trading is expected to commence on December 17, 2025, on the Hong Kong Stock Exchange, marking a significant milestone for both HashKey and the city’s digital asset market.

HashKey's Business Model and Services

HashKey operates a comprehensive crypto platform that extends beyond spot trading. The company is licensed by the Securities and Futures Commission (SFC) under Type 1 and Type 7 licenses, allowing it to provide regulated trading services. Its offerings include spot trading, custody solutions, institutional staking, asset management, and tokenization through the HashKey Chain. As of the third quarter of 2025, HashKey managed approximately 29 billion HKD in staked assets and 7.8 billion HKD in assets under management. The company’s tokenization efforts have resulted in about 1.7 billion HKD in onchain real-world assets, demonstrating its commitment to developing a robust digital asset ecosystem.

Financial Performance and Growth

HashKey’s financial results reflect rapid growth alongside significant investments. Total revenue increased from roughly 129 million HKD in 2022 to 721 million HKD in 2024. However, net losses also grew, nearly doubling from 585.2 million HKD in 2022 to 1.19 billion HKD in 2024, as the company prioritized technology, compliance, and market expansion. In the first half of 2025, HashKey reported a net loss of 506.7 million HKD, indicating a narrowing of losses compared to previous periods. This financial trajectory is typical for companies investing heavily to establish a leading position in a regulated and competitive market.

Use of IPO Proceeds

HashKey has outlined a clear plan for the use of funds raised through its IPO. Approximately 40% of the net proceeds will be directed toward technology and infrastructure upgrades over the next three to five years, supporting the scaling of HashKey Chain, exchange systems, and security enhancements. Another 40% is allocated to market expansion and ecosystem partnerships, enabling the company to enter new jurisdictions and strengthen its network of institutional relationships. The remaining 20% will be split evenly between operations and risk management (10%) and working capital and general corporate purposes (10%), ensuring operational resilience and flexibility. See also: Thumzup Acquisition of Dogehash: Formation of a New Nasdaq Crypto Leader

Significance for Hong Kong's Virtual Asset Market

The HashKey IPO represents a pivotal test for Hong Kong’s virtual asset regulatory regime, offering a glimpse into how regulated crypto infrastructure is received by public markets. The outcome could influence future listings of crypto exchanges and related businesses in the city, while also reflecting Hong Kong’s aspirations to become a leading digital asset hub. The listing underscores the city’s commitment to balancing regulatory oversight with innovation, even as regional challenges persist. See also: NYSE Expands Cryptocurrency Public Listings to Boost Mainstream Capital

Why This Matters

For miners and digital asset participants in Russia, HashKey’s IPO signals growing acceptance of regulated crypto businesses in major financial centers. The success or challenges faced by HashKey may shape how other jurisdictions approach crypto regulation and public listings, potentially affecting global market sentiment and opportunities for expansion.

What Should You Do?

- Monitor the progress and results of HashKey’s IPO to understand how regulated crypto platforms perform in public markets.

- Stay informed about developments in international crypto regulation, as these trends can impact access to services and investment opportunities.

- Evaluate how the evolution of regulated exchanges might influence your own strategies for asset management, trading, or expansion.