Macro analyst Luke Gromen has recently adopted a more cautious stance on Bitcoin, warning that the leading cryptocurrency could fall to the $40,000 range in 2026. This shift comes as he observes changing macroeconomic conditions, increased discussion around quantum computing risks, and technical signals that suggest heightened vulnerability for Bitcoin in the near term.

Luke Gromen's Shift to a Bearish Bitcoin Outlook

Gromen shared his updated perspective during an appearance on the RiskReversal podcast. While he continues to support the core debasement trade thesis—which holds that fiat currencies will lose value over time due to inflation—he now believes that gold and select equities are currently better positioned than Bitcoin to benefit from this trend. According to Gromen, Bitcoin's inability to outperform gold and its recent technical breakdowns are key reasons for his tactical caution. See also: Bitcoin Price Prediction: Analyst Warns of Possible $80K Retest Amid Market Turbulence

Factors Influencing Gromen’s Caution on Bitcoin

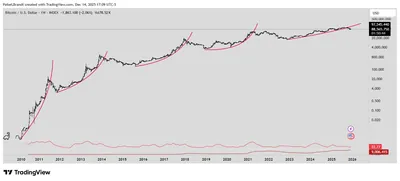

Several factors have contributed to Gromen's more bearish outlook. He points to Bitcoin's failure to reach new highs compared to gold, the breach of important moving averages, and the growing narrative around quantum risk as signs that the risk-reward profile for Bitcoin has worsened. These elements, combined with broader macro uncertainty, have led him to recommend a tactical reduction in Bitcoin exposure, even as he remains structurally bullish on hard assets over the long term.

Quantum Risk and Macro Environment

The conversation around quantum computing has evolved, with some market participants now viewing it as a medium-term risk rather than a purely theoretical concern. However, most cryptographers believe that practical quantum attacks on Bitcoin's cryptography are still a distant possibility. Alongside quantum risk, ongoing macroeconomic jitters—including concerns about the AI industry and weak US economic data—have further weighed on Bitcoin sentiment. See also: Bank of Japan Rate Hike May Push Bitcoin Below $70,000, Say Analysts

Reactions from Bitcoin Analysts

Bitcoin-focused analysts have largely dismissed Gromen's bearish case, arguing that his reasoning is based more on market narratives than on underlying data. They contend that citing broken moving averages and lagging performance versus gold is a common tactic for selling into market weakness, rather than a reliable indicator of a market top. Some analysts also frame the quantum risk discussion as more about perception than actual threat to Bitcoin's security.

Market Data and Long-Term Perspective

Recent market data offers a more nuanced picture. After significant outflows in November, US spot Bitcoin ETFs have returned to modest net inflows in December, suggesting that investor sentiment remains mixed. While Gromen's tactical caution stands out, the broader debasement thesis he supports continues to underpin long-term bullish arguments for both Bitcoin and gold. For now, his position appears to be a temporary adjustment rather than a complete shift away from Bitcoin's role in a diversified portfolio.

Почему это важно

Для российских майнеров, управляющих от одной до тысячи устройств, мнение такого крупного макроаналитика, как Люк Громен, может быть индикатором настроений на мировом рынке. Его осторожность по отношению к биткоину на ближайшие месяцы и годы может повлиять на интерес институциональных инвесторов и, как следствие, на стоимость криптовалюты. Кроме того, обсуждение рисков квантовых вычислений и технических сигналов может усилить волатильность рынка, что важно учитывать при планировании закупок и продаж оборудования.

Что делать?

- Следите за изменениями в макроэкономической обстановке и технических сигналах на рынке биткоина.

- Оценивайте риски, связанные с квантовыми технологиями, но не поддавайтесь панике — большинство специалистов считают практические угрозы далекими.

- Диверсифицируйте портфель: рассматривайте не только биткоин, но и другие активы, такие как золото и акции, если это соответствует вашей стратегии.

- Регулярно анализируйте потоки в ETF и общие настроения на рынке, чтобы своевременно реагировать на изменения.