Kindly MD, a healthcare services company that has transitioned toward a Bitcoin treasury strategy, recently received a notice from Nasdaq after its shares traded below the exchange's $1 minimum bid price for 30 consecutive business days. This notice initiates a 180-day period, ending on June 8, 2026, during which Kindly MD must raise its share price above $1 for at least 10 consecutive trading days to regain compliance with Nasdaq listing standards.

Nasdaq Notice and Compliance Deadline

The Nasdaq notice does not immediately affect Kindly MD's trading but sets clear requirements to maintain its listing. If the company fails to meet the minimum bid price rule within the 180-day window, it may seek an extension by transferring its listing to the Nasdaq Capital Market, provided it meets other listing criteria. Should Kindly MD not satisfy these conditions or pursue available remedies, Nasdaq could ultimately delist its shares.

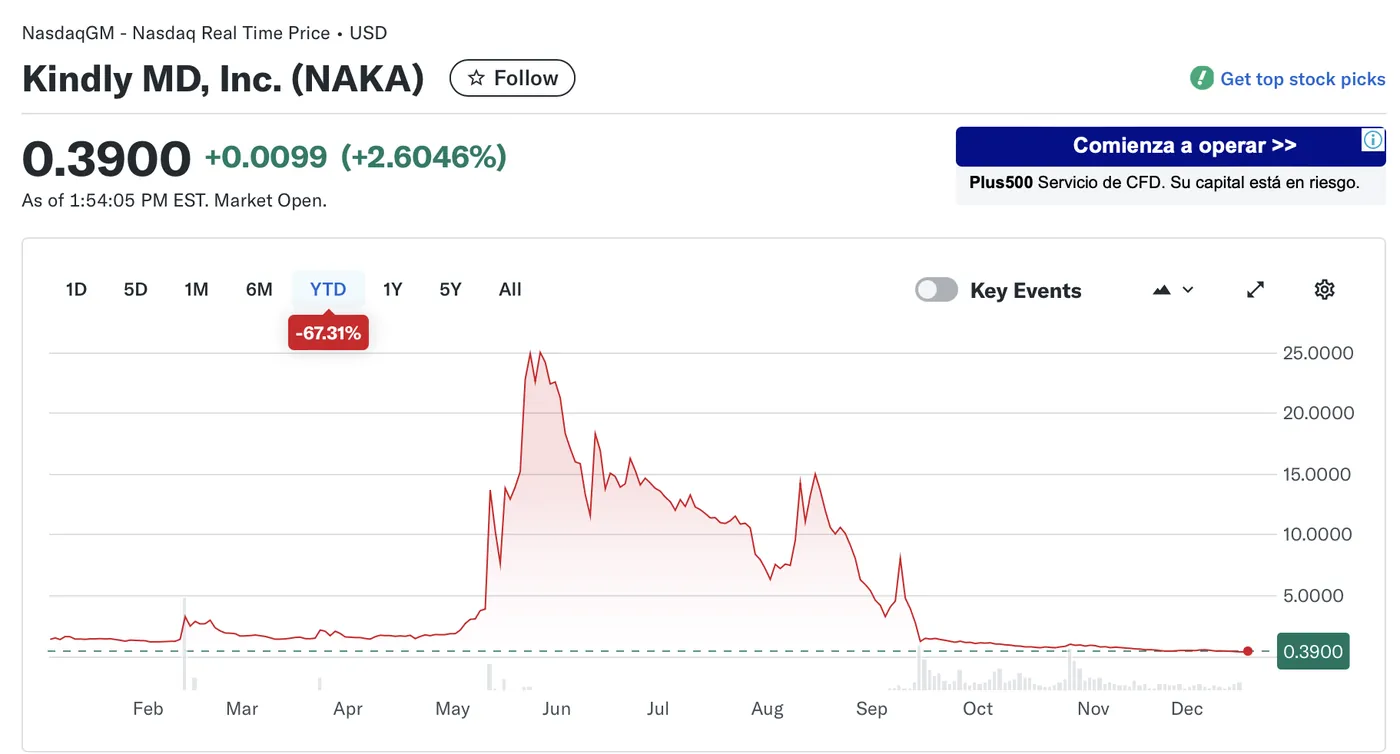

Merger with Nakamoto Holdings and Stock Performance

In May 2025, Kindly MD announced plans to merge with Nakamoto Holdings, a Bitcoin-native holding company founded by Bitcoin Magazine CEO David Bailey. The merger was completed in August 2025, marking a strategic shift toward building a network of crypto treasury businesses. Following the merger announcement, Kindly MD's shares surged to a peak near $25 by late May but subsequently declined sharply, falling over 98% to $0.39 per share by December 2025.

PIPE Financing and Impact on Share Price

The steep decline in Kindly MD's share price has been linked to its financing strategy, which involved raising $563 million through private investment in public equity (PIPE) deals. These deals sold discounted shares to private investors to fund Bitcoin acquisitions but exerted downward pressure on the stock price. When a large portion of these shares became eligible for resale in September, increased sell orders further drove the price down. CEO David Bailey has expressed intentions to consolidate crypto-related businesses such as Bitcoin Magazine and the Bitcoin Conference under Nakamoto Holdings to strengthen cash flow.

Bitcoin Holdings and Strategic Goals

Despite the share price challenges, Kindly MD continues to hold 5,398 Bitcoin, ranking it as the 19th largest public company by Bitcoin holdings. The company has set an ambitious goal to acquire 1 million Bitcoin. For context, Strategy, the first Bitcoin treasury company, holds 671,268 BTC and has seen significant stock appreciation since beginning Bitcoin purchases in 2020.

Kindly MD's situation highlights the complexities of balancing aggressive Bitcoin acquisition strategies with the requirements of public market listings. For more insights on cryptocurrency listings and market strategies, see related articles on NYSE expanding crypto listings and Strategy's Bitcoin reserve growth.

Why This Matters

For miners and investors in Russia managing up to 1,000 devices, Kindly MD's Nasdaq compliance challenge serves as a reminder of the volatility and regulatory risks involved in publicly traded Bitcoin treasury companies. The company's share price decline, influenced by financing strategies and market pressures, can affect investor confidence and liquidity. Understanding these dynamics helps miners assess the stability of companies holding significant Bitcoin reserves and the potential impact on the broader crypto market.

What To Do?

- Monitor Kindly MD's share price movements and Nasdaq compliance updates to gauge market sentiment.

- Consider the implications of PIPE financing and share dilution when evaluating similar companies.

- Stay informed about mergers and strategic shifts in Bitcoin treasury firms, as these can influence stock performance.

- Review related market developments, such as those involving Strategy and Nasdaq listing rules, to better understand industry trends.