On December 15, 2025, Bitcoin rallies faced resistance near intra-day highs, while the market awaits the Bank of Japan's anticipated interest rate hike scheduled for December 19. This expected move has raised concerns about potential downward pressure on Bitcoin and other cryptocurrencies. Meanwhile, several altcoins are striving to maintain their support levels, though recent rebounds have shown limited strength.

Overview of Market Conditions on December 15, 2025

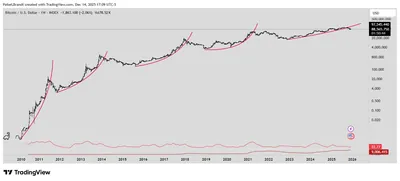

Bitcoin attempted a recovery but encountered renewed selling pressure threatening a decline to $84,000. Trader CrypNuevo highlighted that Bitcoin's price could oscillate between $80,000 and $99,000, with a break below $80,000 possibly pushing it down to $73,000. Analyst Aksel Kibar also anticipates a directional move soon, expecting Bitcoin to reach $100,000 if it surpasses the $94,600 resistance, or to bottom between $73,700 and $76,500 on the downside. See also: Bitcoin Price Outlook December 2025: $90K Support in Focus Amid Key US Data

Market participants are closely monitoring the Bank of Japan's upcoming rate hike, as previous increases since 2024 have led to Bitcoin drawdowns exceeding 20%. This development adds to the general bearish sentiment affecting cryptocurrencies and broader indices. See also: Bank of Japan Rate Hike May Push Bitcoin Below $70,000, Say Analysts

S&P 500 and US Dollar Index Price Predictions

The S&P 500 Index (SPX) recently faced resistance at 6,920, with bears actively defending this level. Should the index break below the moving averages, it may trade between 6,550 and 6,920 for several days. A close below 6,550 would form a double-top pattern, potentially leading to a decline toward 6,180. Conversely, surpassing 6,920 could signal a resumed uptrend targeting 7,290.

The US Dollar Index (DXY) has completed a bearish moving average crossover, with the relative strength index in negative territory, indicating short-term bearish momentum. Minor support exists at 98, with further support levels at 97.20 and 96.21 if the price falls below. Strength would be confirmed by a close above the 20-day exponential moving average and resistance at 100.54. See also: Bitcoin Price Prediction: Analyst Warns of Possible $80K Retest Amid Market Turbulence

Bitcoin (BTC) Price Analysis and Forecast

Bitcoin bounced off its uptrend line but failed to clear the 20-day exponential moving average at $90,720, which has started to turn downward. The relative strength index remains negative, favoring bears. A close below the uptrend line could lead to a drop to $84,000 and possibly to the November 21 low near $80,600. Alternatively, a strong rebound above the 20-day EMA might propel Bitcoin toward the 50-day simple moving average at $95,985. Sellers are expected to defend the zone between this moving average and $100,000, with a break above suggesting an end to the corrective phase.

Altcoins Price Predictions

Ether (ETH) recently rose above its 20-day EMA at $3,106 but faced selling pressure at higher levels. Bears aim to push Ether below $2,907, which could lead to a decline into the $2,716 to $2,623 support zone. A break above $3,350 would invalidate this bearish outlook and could trigger rallies to $3,658 and $3,918.

BNB is under slight bearish pressure after breaking down from a tight trading range. Sellers target the $791 support, with further support at $730. A rebound above the 20-day EMA at $888 could see BNB oscillate between $791 and $1,020.

XRP remains below its 20-day EMA of $2.06, with bears attempting to push it down to support at $1.61 and potentially $1.25 if that fails. Bulls need to break above the 50-day SMA at $2.21 to signal strength.

Solana has formed a symmetrical triangle, reflecting indecision. A breakdown below support could lead to a drop toward $95, while a breakout above resistance may drive prices to $172 and $189.

Dogecoin faces selling pressure below $0.13, risking a fall to $0.10. Bulls must push above the 20-day EMA at $0.14 to target $0.19, suggesting a potential bear trap if the EMA break is reversed.

Cardano is sliding toward critical support at $0.37. A drop below this level could lead to a decline to $0.27. Conversely, breaking above the 20-day EMA at $0.42 may result in consolidation between $0.37 and $0.50, with a move above $0.50 signaling a trend reversal.

Bitcoin Cash (BCH) Price Outlook

Bitcoin Cash has fallen below its 20-day EMA at $560, indicating bearish momentum. Support levels lie at the 50-day SMA of $534 and $508. The price may range between $443 and $615 before buyers can push it above $615 to challenge resistance at $651 and resume an uptrend.

Why This Matters

For miners operating in Russia with up to 1,000 devices, understanding these market conditions is crucial. The expected Bank of Japan interest rate hike historically leads to significant Bitcoin price corrections, which could affect mining profitability and equipment ROI. The current resistance and support levels across major cryptocurrencies and indices provide insight into potential price volatility and market direction in the near term.

What Should Miners Do?

- Monitor Bitcoin price closely, especially key support levels around $80,000 and resistance near $95,000 to $100,000.

- Stay informed about the Bank of Japan's interest rate decision on December 19, as it may trigger market shifts.

- Consider the price trends of major altcoins like Ether, BNB, and XRP to diversify risk exposure.

- Prepare for possible market volatility by managing operational costs and power consumption efficiently.

- Keep an eye on broader financial indicators such as the S&P 500 and US Dollar Index, which can influence crypto market sentiment.