Bitcoin has experienced a 30% decline from its all-time high of $126,200 and currently trades just above the $85,000 support level. This downturn has raised concerns about a possible deeper correction toward the $70,000 range. Despite this, on-chain data reveals that institutions and high-net-worth individuals continue to accumulate Bitcoin, signaling ongoing interest amid market volatility.

Current Bitcoin Market Overview

The recent price drop to just above $85,000 reflects significant market pressure. Investors are closely watching whether Bitcoin will hold this support or face further declines. The possibility of a pullback toward $70,000 remains a key concern for many market participants.

Bitcoin Shark Accumulation Trends

Entities known as Bitcoin "sharks," which hold between 100 and 1,000 BTC, have increased their collective holdings from approximately 3.521 million BTC to 3.575 million BTC over the past week. This represents an absorption of 54,000 BTC, marking the fastest pace of accumulation by mid-sized holders since 2012. Such aggressive buying suggests strong conviction among these investors despite the recent price drop. See also: Bitcoin Drops Below $87,000 Amid $200M BTC Long Liquidations During US Market Sell-Off

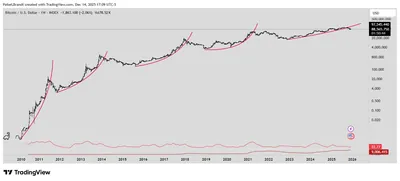

Historically, similar surges in accumulation by mid-sized holders preceded major Bitcoin rallies. In 2012, a comparable increase in accumulation was followed by a 900% price surge within a year, as BTC rose from about $10 to over $100. Likewise, in 2011, aggressive accumulation occurred after a 350% price increase from below $3 to over $14. These patterns highlight the potential for significant upside if history repeats.

Selling Pressure from Long-Term Holders

Contrasting the buying activity of sharks, whales holding over 10,000 BTC have been the primary sellers over the past two months. This selling pressure has contributed to the recent market downturn and has offset some of the accumulation by mid-sized holders. Institutional buying has been substantial but has met equally significant distribution from long-term holders, creating a balance that limits near-term price gains.

Expert Analysis and Price Outlook

Charles Edwards, founder of Capriole Investments, has noted that Bitcoin's price appreciation may remain capped until the heavy distribution from older coins subsides. This suggests that the selling pressure from long-term holders continues to weigh on the market. See also: Bitcoin Drops Below $86,000 Amid $2.78B Whale Selling Pressure

Additionally, veteran trader Peter Brandt has pointed out that Bitcoin's recent breakdown below its parabolic support is historically associated with an approximate 80% price decline. If this fractal pattern repeats, Bitcoin's price could fall as low as $25,000, indicating significant downside risk. See also: Bitcoin Long-Term Holder Supply Decline and Price Support Analysis

Why This Matters

For miners operating in Russia with up to 1,000 devices, understanding these market dynamics is crucial. The aggressive accumulation by mid-sized holders may signal confidence in Bitcoin's long-term value, but the ongoing selling by large whales introduces volatility and potential price declines. This environment affects the profitability and strategic decisions of miners, especially when considering electricity costs and hardware investments.

What To Do?

- Monitor Bitcoin price levels closely, especially the $85,000 support and potential drops toward $70,000 or lower.

- Stay informed about accumulation trends among mid-sized holders and selling activity from whales to gauge market sentiment.

- Evaluate mining operations' cost efficiency to withstand possible price volatility.

- Consider risk management strategies, including diversification and cautious reinvestment, during periods of high market uncertainty.