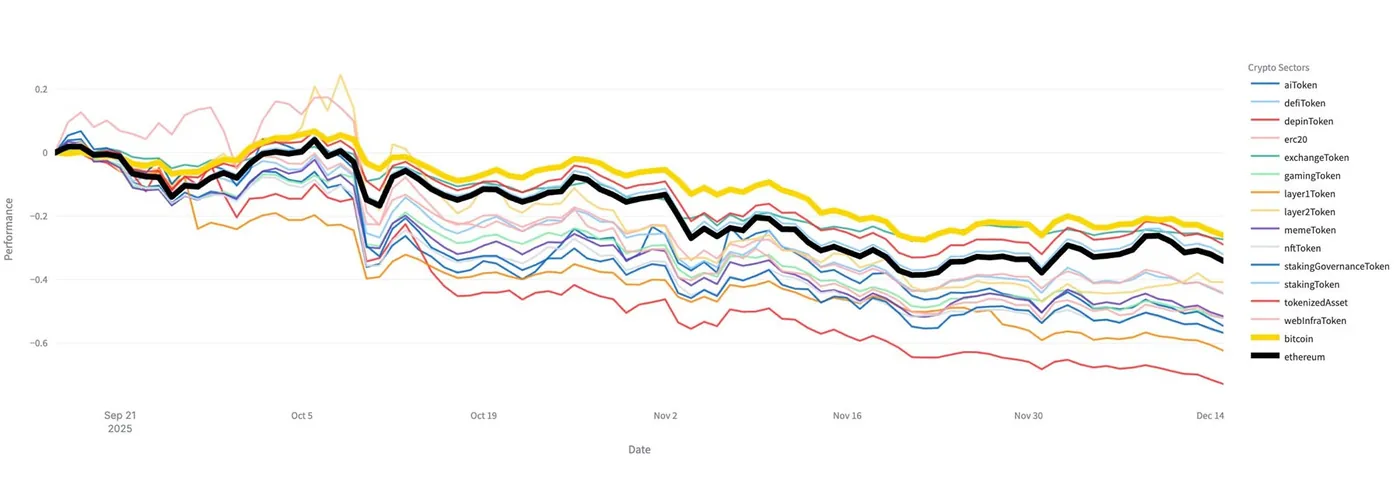

Over the past three months, Bitcoin has experienced a 26% decline, reaching levels around $86,000. Despite this drop, Bitcoin's performance has surpassed that of most other cryptocurrency sectors, indicating sustained investor interest and capital preference for BTC. During the same period, the total cryptocurrency market capitalization fell by 27.5%, reflecting a broad market downturn.

Overview of Cryptocurrency Performance in the Last Three Months

While Bitcoin's value decreased by 26%, other major cryptocurrencies and sectors faced steeper losses. Ether, for example, declined by 36%, underperforming Bitcoin notably. More pronounced declines were seen in specialized sectors such as AI tokens, which fell 48%, and memecoins, which dipped 56%. These figures highlight the varying degrees of market impact across different crypto categories.

Sector-Specific Performance Details

Beyond the major coins, specific token categories also suffered significant declines. The real-world asset tokenization sector dropped 46%, while DeFi tokens decreased by 38% over the same three-month timeframe. When comparing these returns to Bitcoin's, it becomes clear that Bitcoin has maintained a relatively stronger position amid widespread losses.

Market Analysis and Expert Opinions

On-chain analytics platform Glassnode reported that average returns across nearly all crypto sectors have underperformed Bitcoin during this period. Meanwhile, Bitcoin Vector observed that Bitcoin's dominance declined in the year's second half, allowing some rotation into Ether, though Bitcoin did not fully lose its leadership. Nick Ruck, director of LVRG Research, emphasized that capital inflows continue to favor Bitcoin, reflecting investors' preference for its stability as a safer haven amid ongoing market volatility.

Implications for Investors and Market Trends

The concentration of capital in Bitcoin amid struggles faced by altcoins suggests a market searching for stability after recent deleveraging events. This dynamic underscores Bitcoin's dominant role and may influence investment strategies for miners and holders alike. Understanding these trends can help miners with varying scales of operation in Russia navigate the current market landscape more effectively.

Why This Matters

For miners operating from a single device up to larger setups, recognizing Bitcoin's relative resilience is crucial. Despite a notable price drop, Bitcoin remains a preferred asset, attracting more capital than other crypto sectors. This preference can affect mining profitability and decisions on which cryptocurrencies to focus resources on, especially as other sectors face sharper declines.

What Should Miners Do?

- Monitor Bitcoin's price trends closely, as its relative strength may offer more stable returns compared to other tokens.

- Consider the broader market context, including the underperformance of AI tokens, memecoins, and DeFi sectors, when planning mining operations.

- Stay informed about expert analyses and market data from sources like Glassnode and CoinMarketCap to adjust strategies accordingly.

- Evaluate the benefits of focusing mining efforts on Bitcoin versus diversifying into other sectors that may be more volatile or declining.

For more insights on market dynamics and trading volume trends, miners can refer to related analyses such as Crypto Spot Trading Volumes Fall 66% in Late 2025 and Crypto Market Correction Amid Fed Chair Uncertainty and AI Bubble Fears.