Bitcoin’s well-known four-year cycle continues to influence the market, but the underlying drivers have shifted significantly. Markus Thielen, head of research at 10x Research, emphasizes that while the cycle remains, it is now primarily shaped by political events, liquidity conditions, and election cycles rather than the programmed halving of Bitcoin’s supply.

Overview of Bitcoin's Four-Year Cycle

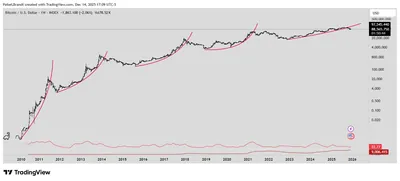

Traditionally, Bitcoin’s four-year cycle was closely tied to the halving event, which reduces the rate at which new coins are created. However, Thielen points out that this narrative is evolving. He believes the cycle is still intact, but its timing and causes are increasingly linked to broader political and economic factors. The schedule of Bitcoin halvings has also shifted over time, making the connection less direct.

Influence of Politics and Liquidity

Thielen highlights that major Bitcoin market peaks in 2013, 2017, and 2021 all took place in the fourth quarter, coinciding with periods of heightened political activity in the US, such as presidential elections. He argues that these peaks are more closely related to political uncertainty and changes in liquidity than to the halving itself. Central bank policies and capital flows now play a crucial role in shaping market cycles, as investors respond to signals from policymakers and shifts in risk appetite. See also: Luke Gromen Turns Bearish on Bitcoin: Warns of $40K Risk in 2026

Recent Market Behavior and Federal Reserve Impact

Recently, Bitcoin has struggled to regain momentum following the Federal Reserve’s latest rate cut. While such cuts have historically boosted risk assets, the current environment is different. Institutional investors, who now lead the crypto market, are acting more cautiously amid mixed policy signals and tightening liquidity. As a result, capital inflows into Bitcoin have slowed, reducing the pressure needed for a strong price rally. Without a clear increase in liquidity, Thielen expects Bitcoin to remain in a consolidation phase rather than entering a new parabolic run. See also: Grayscale Forecasts Bitcoin to Reach New All-Time High in Early 2026

Alternative Perspectives on Bitcoin Cycles

Not all analysts agree on the persistence of the four-year cycle. Arthur Hayes, co-founder of BitMEX, contends that the cycle is effectively over. He argues that global liquidity, not the halving or fixed timelines, has always been the main driver behind Bitcoin’s market movements. According to Hayes, past bull markets ended when monetary conditions tightened, particularly when liquidity in major currencies like the US dollar and Chinese yuan slowed. He suggests that traders relying solely on historical timing models may be misled in the current environment.

Implications for Investors

For investors, these shifts mean that monitoring political developments, central bank policies, and liquidity trends is now more important than focusing on halving events alone. Timing strategies based solely on the halving may no longer be effective. Instead, staying alert to fiscal policy debates, election outcomes, and changes in global liquidity will be key to understanding Bitcoin’s potential movements in 2025 and beyond.

Почему это важно

Для майнеров в России понимание новых факторов, влияющих на цикл Биткоина, помогает лучше оценивать риски и планировать стратегию. Если раньше многие ориентировались на халвинг, теперь стоит уделять больше внимания политическим событиям и решениям центральных банков, которые могут влиять на цену и доходность майнинга.

Что делать?

- Следите за новостями о выборах в США и других крупных странах, а также за изменениями в политике центральных банков.

- Оценивайте свою стратегию не только по дате халвинга, но и по общей ситуации с ликвидностью на рынках.

- Будьте готовы к периоду консолидации и не рассчитывайте только на исторические модели роста.