Michael Saylor has continued his well-known approach to Bitcoin accumulation in 2025, marked by his regular Monday morning purchases. This disciplined strategy has become a defining feature of his investment philosophy, emphasizing steady and predictable accumulation over time.

Overview of Michael Saylor's Bitcoin Buying Strategy

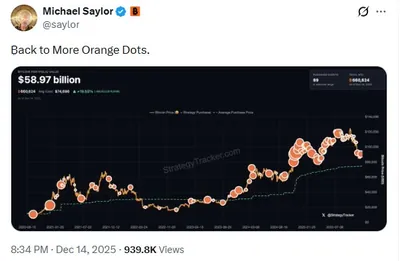

Saylor’s strategy centers on a ritualistic Monday morning buy, which has become both a personal trademark and a signal to the broader market. The primary goal is to steadily increase his Bitcoin holdings, regardless of short-term price movements, reflecting a long-term belief in Bitcoin’s value. See also: Michael Saylor Buys Nearly $1 Billion in Bitcoin, Price Drops 4%

Recent Bitcoin Purchases by Michael Saylor

In 2025, Saylor’s accumulation efforts resulted in the addition of 10,645 Bitcoin. These purchases were made as part of his ongoing weekly routine, reinforcing his commitment to a systematic approach rather than opportunistic trading.

Market Impact and Analysis

Saylor’s consistent buying has not gone unnoticed by the cryptocurrency community. Each Monday morning purchase often sparks discussion among investors and analysts about its potential influence on Bitcoin’s price. While the direct effect on the market can vary, his unwavering accumulation strategy is seen as a vote of confidence in Bitcoin’s future. See also: Michael Saylor Hints at Next Bitcoin Buy as BTC Drops Below $88,000

Future Outlook

Looking ahead, Saylor’s Monday morning ritual is expected to remain a central element of his Bitcoin strategy. This approach may continue to inspire other investors to adopt similar disciplined accumulation methods, shaping trends in Bitcoin ownership and market sentiment.

Почему это важно

Для российских майнеров действия таких крупных игроков, как Майкл Сэйлор, служат индикатором доверия к биткоину на мировом уровне. Стабильная стратегия накопления может поддерживать интерес к майнингу и влиять на долгосрочные ожидания относительно курса.

Что делать?

Майнерам стоит следить за подобными стратегиями крупных инвесторов, чтобы понимать общие тенденции рынка. Это поможет принимать более взвешенные решения по удержанию или продаже добытых монет, а также планировать дальнейшее развитие майнингового бизнеса.