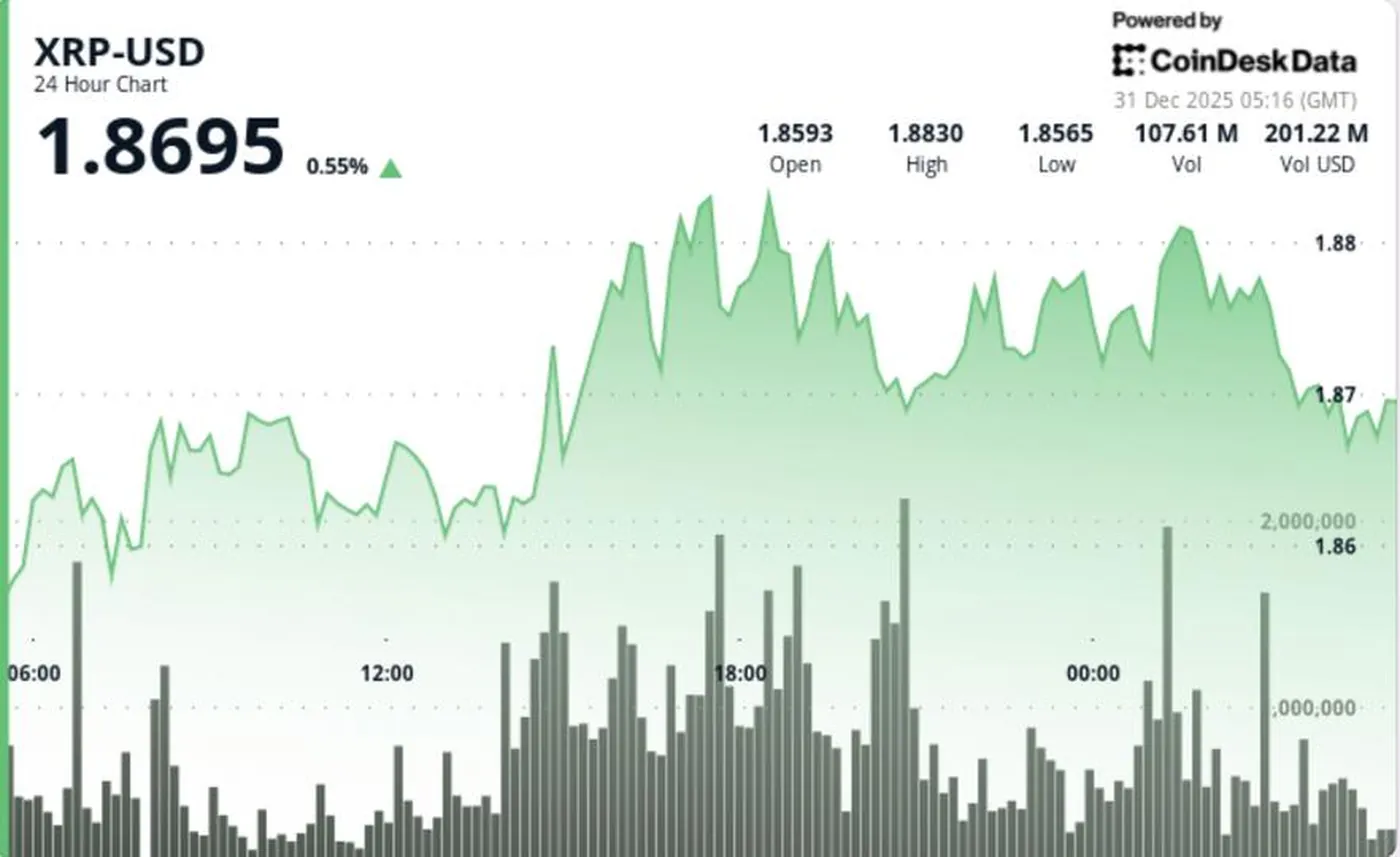

XRP is trading at approximately $1.87, despite a significant increase in trading volumes—about 20.8% above weekly averages. The price remains confined within a narrow corridor around the key support level of $1.85, indicating market compression and heightened sensitivity to news and liquidity.

Current XRP Market Situation

The volume increase alongside an almost unchanged price suggests position reshuffling rather than panic selling or pure accumulation. During the same period, XRP balances on exchanges fell to multi-year lows, while derivatives open interest rose to $3.43 billion, creating tension between spot and futures markets.

Additionally, institutional capital inflows are noticeable through exchange-traded funds: spot XRP ETFs have attracted about $1.25 billion in net inflows since November, differing from the wave-like flows seen in other ETFs. Together, these factors keep the price tethered to nearby support and resistance levels.

Expert Forecasts and Opinions

Standard Chartered has confirmed one of the most optimistic institutional forecasts, expecting XRP to reach $8 by the end of 2026. The bank emphasizes that improved regulatory clarity in the U.S. provides Ripple and the XRP ecosystem with more room to grow without constant risk pressure from ongoing legal disputes.

Geoff Kendrick, head of digital asset research at Standard Chartered, highlights the impact of regulatory clarity on institutional demand and the potential for scaling projects around XRP. These views reflect a shift in risk perception among major players but do not guarantee automatic price growth.

Market Analysis and Structure

The market structure shows a combination of inflows through ETFs and decreasing exchange balances—a situation traders typically interpret as liquidity compression. Meanwhile, open interest rose to $3.43 billion, and spot net flows were negative by approximately $10.7 million, adding nuance: leverage is increasing while confirmed spot demand is absent.

This scenario may amplify volatility: if demand persists, the reduction of available liquidity on exchanges could intensify price movements during sudden sentiment shifts. The calendar factor is also important—the nearest clear event is the scheduled release of 1 billion XRP from escrow in January 2026, which traditionally increases market sensitivity to supply.

Technical Analysis

A brief technical snapshot confirms that $1.85 remains a key support line: the price tested this zone and avoided a sharp drop, while attempts to rise above $1.8792 met selling pressure. Moving averages are still trending downward, limiting short-term growth potential.

- The price failed to break resistance at $1.8792, indicating seller interest during rallies.

- The $1.85 support level remains critical to maintaining the current balance of forces.

- Volume growth amid compressed price action creates the risk of sharp moves once compression resolves.

Upcoming Catalysts

The main drivers in the near term will be institutional flows through ETFs and calendar events, particularly the planned release of 1 billion XRP from escrow in January 2026. Even if a significant portion of these coins is re-escrowed, the event heightens market sensitivity to supply and liquidity.

Why This Matters

For miners with 1–1000 devices in Russia, the current situation means an increased likelihood of sharp price movements despite relative price stability now. The combination of declining exchange balances and rising open interest could amplify price volatility, affecting ruble revenue when converting mining rewards.

Moreover, institutional inflows via ETFs and improved regulatory environment simplify large capital access to XRP but do not exclude short-term volatility around escrow releases and technical levels. For miners, this means periods of relative calm can quickly shift to strong moves.

What To Do?

Manage risks and control liquidity: regularly check how much cryptocurrency you hold on exchanges and prioritize cold storage when there is no urgent need to sell. If you convert mining income to rubles or stable assets, do so gradually to reduce the impact of sudden price swings.

Monitor key levels at $1.85 and $1.8792 as well as calendar events like escrow releases and ETF inflows—these factors can signal when to adjust selling volumes or take profits. Maintain cash reserves for electricity and equipment maintenance in case of sharp price drops.

Frequently Asked Questions

What does Standard Chartered forecast for XRP? Standard Chartered expects XRP to reach $8 by the end of 2026, according to the bank's confirmed forecast.

Why does the price stay around $1.87 despite rising volumes? The article notes that trading volumes increased about 20.8% above weekly averages, but the price remained in a narrow range, interpreted as position reshuffling and preparation for a possible stronger move.

What are the nearest market catalysts? The closest calendar catalyst is the planned release of 1 billion XRP from escrow in January 2026; inflows into spot ETFs and exchange liquidity levels also play important roles.

For more on the impact of ETFs and regulatory clarity, see our review XRP — 2026 Forecast: ETFs, Regulatory Clarity, and Corporate Treasuries, and for a technical breakdown of the $1.87 support, see $1.87 Support Under Threat.