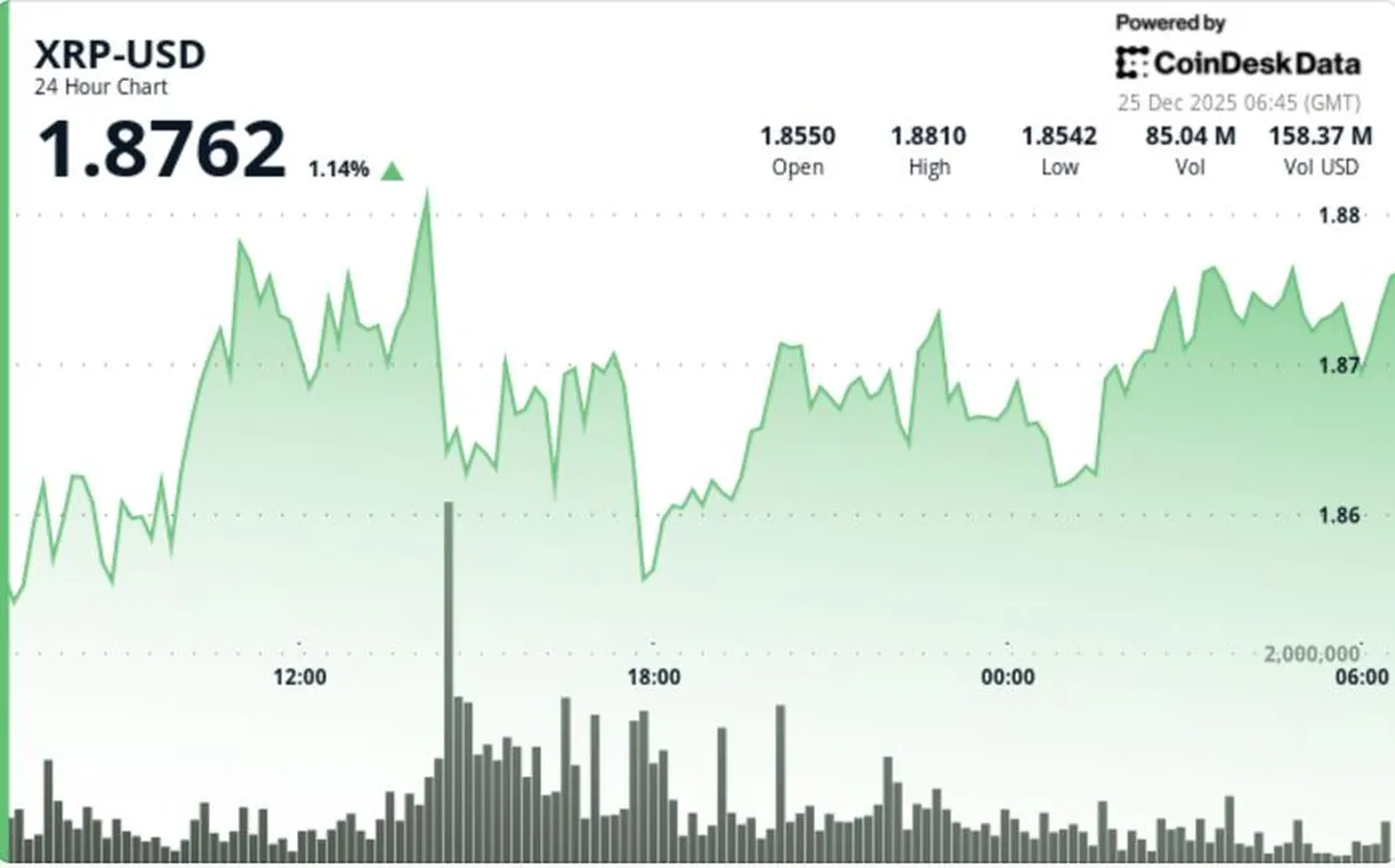

Assets managed by XRP ETFs increased to $1.25 billion after investors added $8.19 million in recent sessions. Meanwhile, XRP's price fell to $1.86 and continues to trade within a narrow range of $1.85–$1.91, indicating restrained market dynamics.

XRP ETF Assets Reach $1.25 Billion

Fund flows into ETFs demonstrate that institutional demand for XRP remains significant: in recent sessions, an additional $8.19 million flowed into funds, raising total assets to $1.25 billion. This growth confirms that some professional investors prefer structured and regulated instruments for XRP exposure rather than direct spot purchases.

The underlying stability of demand through ETFs helps maintain long-term interest in the asset, even if short-term prices remain under pressure. At the same time, the market continues to redistribute volumes around key technical zones — evident in trading activity and volumes.

Technical Analysis of XRP Price

During the session, XRP’s price dropped from about $1.88 to $1.86 and stayed within the $1.85–$1.91 channel, where sellers repeatedly defended the $1.9060–$1.9100 area. Trading volume sharply increased to 75.3 million coins — roughly 76% above average — indicating that the price deviation was accompanied by real liquidity rather than a "quiet" drift.

A brief attempt to break out of the consolidation pool around $1.854–$1.858 triggered a spike in activity and a test of $1.862, but the momentum didn’t hold, and the price returned to $1.86. Consistent bid orders in the $1.86–$1.87 range helped limit a sharper decline.

What Traders Need to Know

- ETF flows provide background support, but short-term traders continue selling near $1.90–$1.91.

- Key levels to watch: $1.87 as immediate support and $1.86 as a critical lower boundary, holding which is important for stabilization.

- Scenarios: if $1.87 holds and recovers to $1.875–$1.88, a retest of the $1.90–$1.91 zone is likely; if $1.86 fails, the market may slide to lower demand levels.

For additional context on why ETF inflows don’t always immediately push prices higher, it’s helpful to review the analysis of fund flows in XRP Spot ETF in the middle of the article. The support situation is further detailed in the piece about support at $1.87, and the role of large sellers can be compared with the analysis of whale sales.

Why This Matters

For miners, price fluctuations and high trading activity directly impact decisions on when to sell mined cryptocurrency and convert it into rubles. Even with stable ETF inflows, the presence of active sellers near $1.90–$1.91 makes the price more sensitive to short-term liquidity spikes.

The increase in trading volume (75.3 million, about 76% above average) indicates heightened market participation: this can offer more opportunities for partial sales at acceptable prices but also raises the likelihood of quick pullbacks after spikes. For small farm owners, this means monitoring local levels is more important than blindly reacting to ETF inflow news.

What To Do?

- Watch the $1.86 and $1.87 levels as immediate reference points for stop-losses and sell limits.

- If planning to sell mined XRP, split volumes into parts to avoid pressuring the price in active selling zones.

- Use limit orders near confirmed bids rather than market orders during volume spikes to avoid slippage.

- Monitor ETF inflows and volume changes — steady inflows can serve as an additional buffer against sharp declines.

- Maintain reserves in fiat or stablecoins for sudden moves to avoid selling at the worst moments.