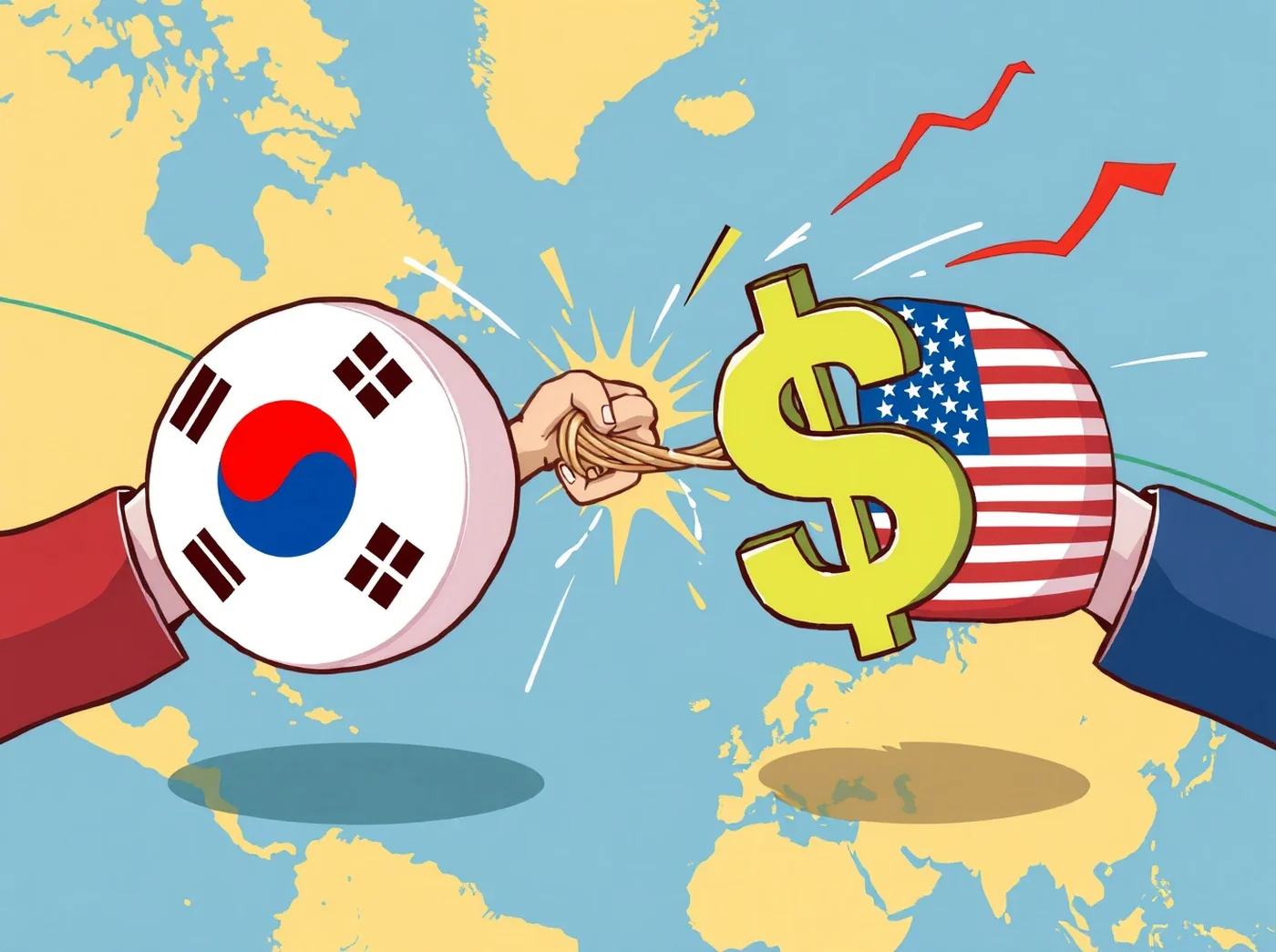

The exchange rate between the South Korean Won and the US Dollar has recently reached the 1480 level, a milestone not seen in the past eight months. This development reflects significant currency fluctuations that have implications for various economic sectors.

Overview of the Won-Dollar Exchange Rate

The Won-Dollar exchange rate represents the value of the South Korean currency relative to the US Dollar, serving as a key indicator in international trade and finance. The recent rise to the 1480 level marks a critical point, highlighting shifts in currency strength and market dynamics. Prior to this, the exchange rate had remained below this threshold for several months, making the current level noteworthy.

Historical Context

Over the past eight months, the Won-Dollar exchange rate has experienced fluctuations influenced by multiple factors, including global economic conditions, trade balances, and monetary policies. Previous critical levels have similarly impacted economic activities, with shifts in the exchange rate affecting competitiveness and pricing. Understanding these historical patterns helps contextualize the significance of the current 1480 level.

Economic Implications

The movement of the Won-Dollar exchange rate directly affects South Korea's economy. A higher exchange rate can influence exports by making South Korean goods more expensive for foreign buyers, potentially reducing demand. Conversely, imports may become cheaper, affecting domestic markets. Additionally, changes in the exchange rate can impact inflation rates and consumer prices, prompting adjustments in monetary policy and interest rates by financial authorities.

Future Outlook

Looking ahead, the exchange rate's trajectory will be shaped by ongoing economic developments and policy decisions. Investors and policymakers should remain attentive to potential risks and opportunities arising from currency movements. Government and central bank responses will play a crucial role in managing the economic effects associated with exchange rate fluctuations.

Why This Matters

For miners and small-scale operators in South Korea, understanding the Won-Dollar exchange rate is important even if it does not directly affect mining operations. Currency fluctuations can influence electricity costs, import prices for mining equipment, and overall economic stability, which in turn may impact operational expenses and profitability.

What To Do

- Stay informed about exchange rate trends and economic policies that may affect operational costs.

- Consider currency risk management strategies if importing mining hardware or related equipment.

- Monitor government announcements for any measures that could influence energy prices or trade conditions.