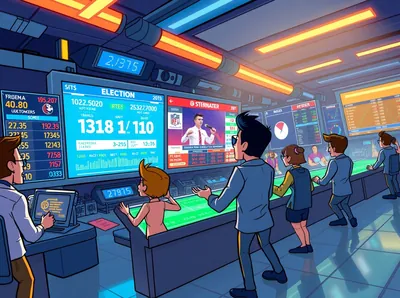

Prediction markets moved from niche experiments to a mainstream financial category in 2025, driven by surging volumes, high-profile deals, and repeated legal tests. Two platforms, Kalshi and Polymarket, dominated headlines as they expanded trading, struck partnerships, and faced regulators while attracting Wall Street attention. The year combined courtroom rulings, major integrations, and record industry-wide activity without settling all regulatory questions.

The Rise of Prediction Markets in 2025

What began as event-based betting evolved into an ecosystem used for sports, economics, crypto, and political forecasting, attracting both retail and institutional interest. Trading volumes climbed sharply across leading platforms, with several services reporting multibillion-dollar monthly and weekly totals; industry-wide activity reached historic highs by year end, reflecting broad user participation and deeper liquidity. For reporting focused on daily volume patterns, see trading volumes coverage.

Key Legal and Regulatory Developments

The year opened with legal battles that shaped market access. Polymarket entered January averaging more than $1 billion in monthly trading volume, while Kalshi challenged federal limits on political contracts in court and faced state-level enforcement actions that questioned whether some event markets resembled unlawful gambling. In March, New Jersey regulators issued a cease-and-desist order against Kalshi, and in April a federal judge blocked that state enforcement, a decision that left federal commodities law as a critical factor in how these markets are regulated.

The Commodity Futures Trading Commission engaged publicly on event contracts, and market operators pursued regulatory pathways to operate in the U.S. Polymarket acquired a small CFTC-licensed exchange in June to facilitate a U.S. return, and by September Polymarket regained approval to operate in the United States, narrowing one regulatory obstacle even as state-level disputes continued.

Major Partnerships and Integrations

Partnerships and integrations broadened distribution and visibility for prediction markets. Kalshi inked a distribution partnership with Robinhood in June to reach retail traders directly inside a popular trading app, while Polymarket and others worked on U.S. re-entry plans with licensed infrastructure. At the same time, large media and tech platforms began incorporating prediction-data feeds, increasing mainstream exposure and embedding probabilistic forecasts into familiar interfaces.

Wall Street interest intensified: Intercontinental Exchange (ICE), owner of the NYSE, announced plans to invest up to $2 billion in Polymarket, signaling strong institutional curiosity and potential for deeper market infrastructure ties. Media integrations and sports partnerships also increased the channels through which users encounter prediction markets, expanding both audience and use cases.

Record Growth and Market Expansion

Growth accelerated as legal clarity and distribution deals unlocked user growth and capital. By May, Kalshi reported weekly volumes approaching $1 billion, and later in the year both Kalshi and Polymarket posted multibillion-dollar monthly totals. Industry-wide trading was estimated at roughly $44 billion for the year, a scale that shifted the conversation from novelty to a recognizable market segment.

New entrants and regulated offerings added competition and choice. DraftKings launched a federally compliant prediction app in dozens of states, validating regulatory approaches and widening retail access, while blockchain-native projects appeared alongside licensed exchanges, creating a mix of settlement models and product designs.

The Future of Prediction Markets

By year’s end, prediction markets had begun to look like an emergent asset class that blends regulated exchange models, blockchain settlement, and crowd-based forecasting. Ongoing litigation and state-level resistance remain unresolved, but the combination of funding, partnerships, and mainstream integrations suggests the sector will keep evolving. How far it expands will depend on regulatory outcomes, platform strategy, and continued user demand.

Why this matters

If you run mining hardware in Russia, this is relevant even if you don’t trade on prediction sites. Broader mainstream adoption means more attention to settlement rails, onramps, and compliance — factors that affect how crypto flows between services you might use. Increased integration with mainstream apps and media can raise public awareness and regulatory scrutiny around crypto-linked products, which indirectly shapes the environment for miners who sell or use earned crypto.

At the same time, most developments described here concern platform markets, partnerships, and legal rulings rather than changes to mining protocols or blockchain fundamentals. That means immediate technical operations for mining rigs don’t change, but the surrounding ecosystem for selling, hedging, or using mined coins can shift as products and regulations evolve.

What to do?

Practical steps for a miner with between 1 and 1,000 devices in Russia focus on readiness and simple risk management. Keep routine operations stable while monitoring regulatory and exchange developments that affect how you convert or spend cryptocurrency. Below are concrete actions to consider:

- Monitor exchanges and services you use for deposit/withdrawal limits and compliance updates, especially if they integrate prediction-market products.

- Maintain diversified cash-out routes (multiple exchanges or fiat off-ramps) so regulatory moves affecting one channel don’t lock you out.

- Keep software and wallet security current, and separate funds used for trading from operational reserves for mining costs.

- Follow news about platform approvals and major partnerships to anticipate changes in liquidity or fee structures that affect sale timing.

- Document your revenue and transfers to simplify tax reporting and respond quickly if a service changes its policies.

For more on how daily trading patterns evolved and affected volume expectations, see reporting on trading volumes. If you want detail on regulated prediction apps, read the piece about DraftKings Predictions. For a perspective on how markets can serve forecasting roles beyond betting, see the discussion of macro indicators.

FAQ

What are prediction markets? Platforms where users trade contracts tied to real-world event outcomes, such as sports results, economic indicators, or political events.

Why did prediction markets grow fast in 2025? Growth was driven by regulatory developments, high-profile partnerships, increased funding, and broader media and tech integrations that expanded reach and liquidity.

Which platforms dominated 2025? Kalshi and Polymarket were the leading platforms by volume, funding activity, and mainstream integration.

How are prediction markets connected to crypto? Some platforms use blockchain infrastructure, stablecoins, and decentralized settlement tools alongside regulated exchange models.