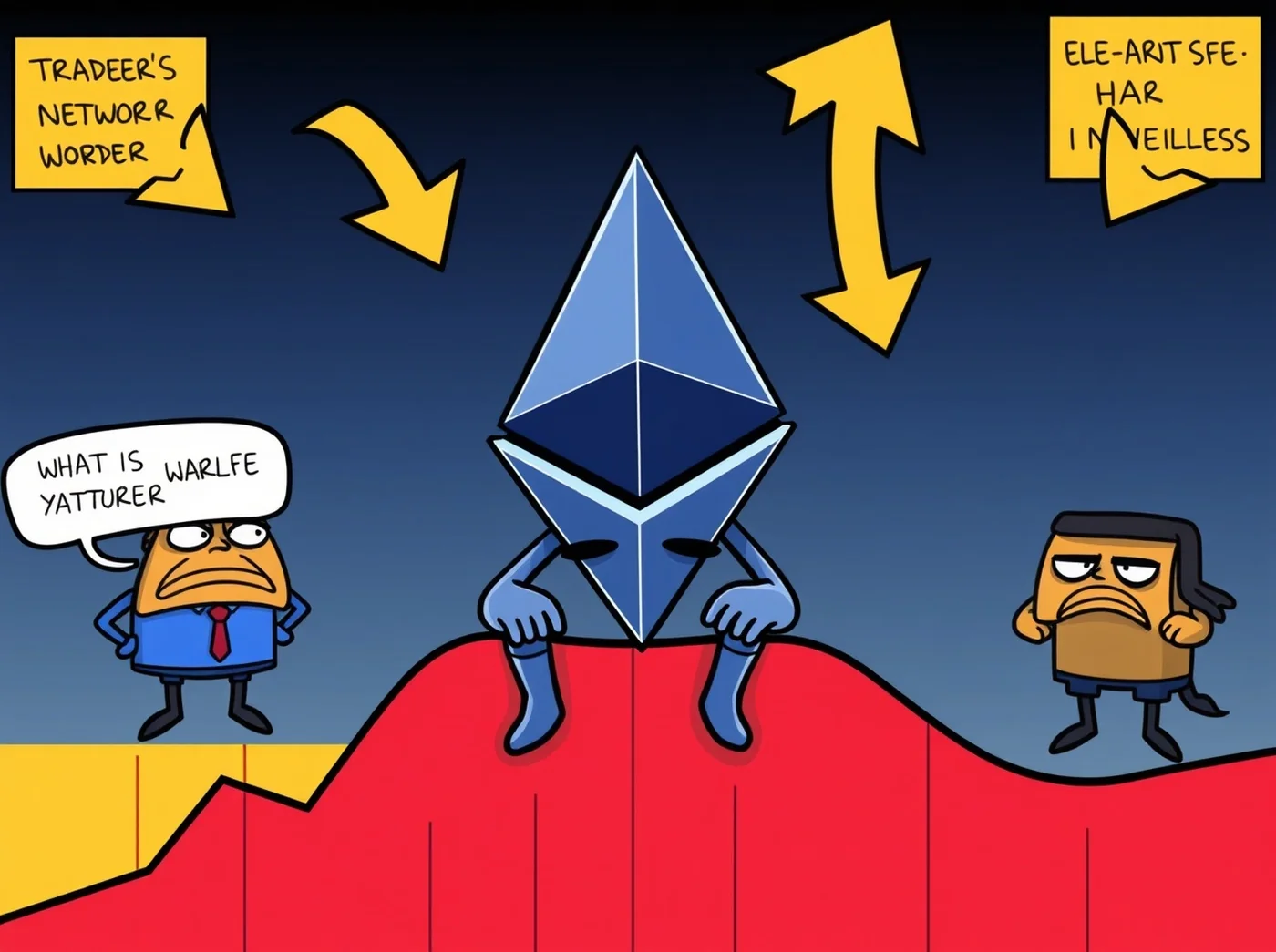

Ethereum has faced a significant price decline recently, reflecting broader market conditions and specific challenges within the cryptocurrency ecosystem. This drop has raised concerns among investors and market participants who are closely monitoring the factors influencing Ethereum's value.

Overview of Ethereum Price Decline

The recent fall in Ethereum's price can be attributed to a combination of general market downturns and particular events affecting the cryptocurrency sector. These conditions have created a challenging environment for Ethereum, contributing to its decreased valuation.

Key Factors Behind Ethereum Price Drop

Several critical factors have played a role in the decline of Ethereum's price. Firstly, market-wide sell-offs and investor caution have reduced demand. Secondly, notable transactions by large holders, such as anonymous Ethereum whales selling substantial amounts of ETH, have influenced market sentiment. Thirdly, broader economic uncertainties and regulatory concerns continue to impact investor confidence.

Implications for Investors

The price decline affects investors by increasing market volatility and risk exposure. Those holding Ethereum may experience decreased portfolio values, prompting a reassessment of investment strategies. Managing risks through diversification and staying informed about market developments are essential approaches during such periods.

Future Outlook for Ethereum

Looking ahead, Ethereum's price trajectory will depend on how current trends evolve. While challenges remain, potential recovery scenarios exist if market conditions improve and investor confidence returns. Continuous monitoring of market indicators and related developments will be crucial for anticipating Ethereum's future performance.

For a broader understanding of cryptocurrency market movements, consider exploring analyses such as major causes of Bitcoin’s price decline and insights into cryptomarket corrections in 2024. These resources provide context that complements the factors affecting Ethereum's price.