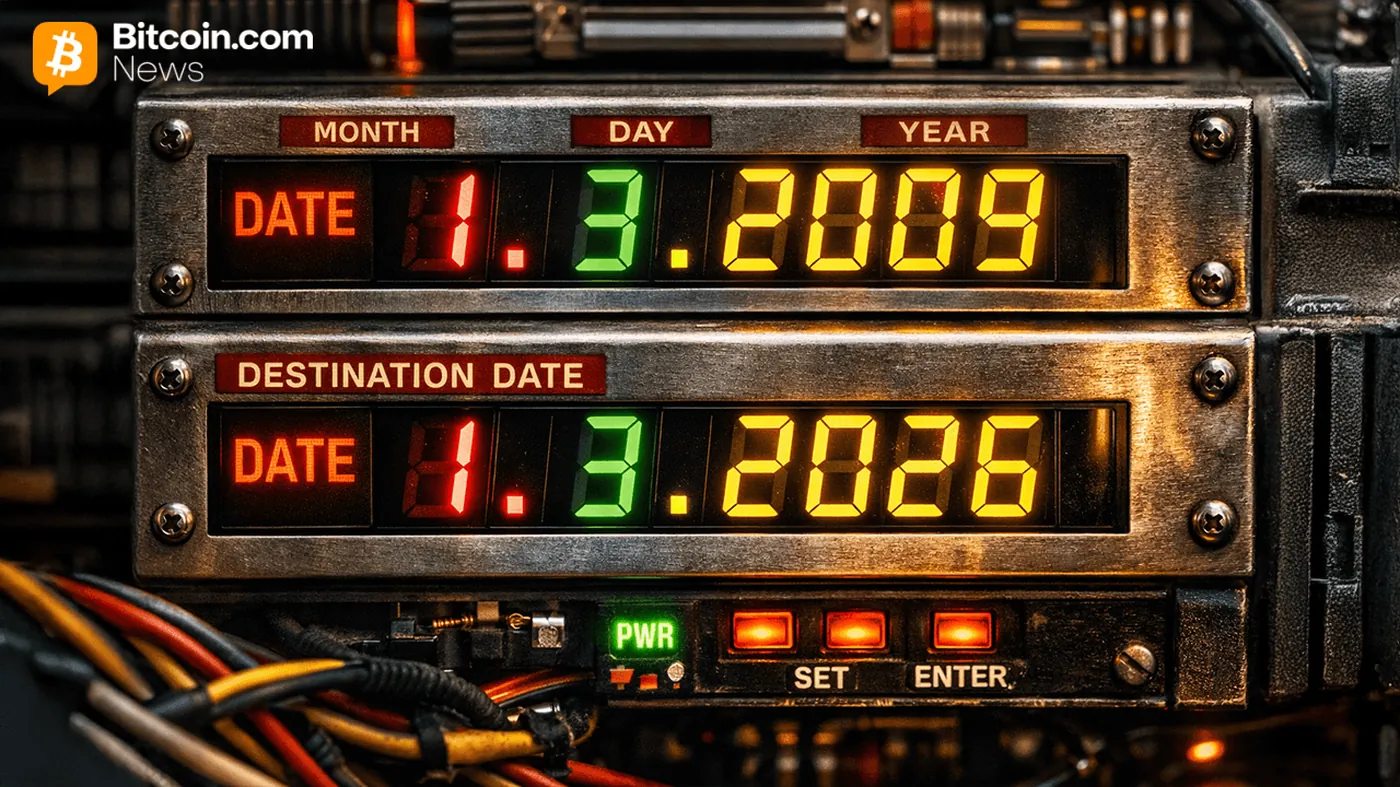

Bitcoin marked its 17th year since the genesis block was mined on January 3, 2009, a moment that embedded a pointed message about bank bailouts into the first block. What began as a technical experiment gradually became a global financial phenomenon, driven by protocol upgrades, market cycles, and repeated tests of resilience. This article lays out the main milestones in that evolution and explains what they mean for miners today.

The Birth of Bitcoin

Bitcoin’s genesis block, mined on January 3, 2009, launched a permissionless, code-governed network that arrived amid widespread distrust of traditional finance. In its early years the system was treated more as a curiosity than a medium of exchange, but the embedded message in the first block signaled a clear ideological foundation. Those first releases and conversations set the tone for later technical and social development.

Key Milestones in Bitcoin's History

The first widely known real-world transaction came in 2010, when 10,000 BTC were spent for two pizzas — a trade that has become part of Bitcoin lore and a reminder of how early value was perceived. By 2011, BTC crossed $1 for the first time, drawing attention beyond cryptography circles and exposing the system to broader markets. The first block reward halving in 2012 signaled a move toward an engineered monetary supply, and by 2013 prices had risen to over $1,000, an inflection that brought new users, ATMs, and regulatory scrutiny.

Challenges and Resilience

Bitcoin’s history includes severe setbacks that tested its infrastructure and community. The collapse of Mt. Gox in 2014 was a major shock to exchanges and market confidence, while later centralized failures further separated custodial risk from the base protocol. Through those episodes the network continued to produce blocks, and metrics like hashrate and uptime showed recovery and growth.

Mainstream Adoption and Institutional Interest

Adoption moved from hobbyist circles into mainstream finance and state policy over the following years. Japan recognized Bitcoin for payments in 2017, and one country later adopted it as legal tender, demonstrating novel national-level use cases. Institutional access expanded with custody services, futures platforms, and ultimately the U.S. approval of spot Bitcoin ETFs, which broadened the set of market participants holding BTC.

Bitcoin's Evolution and Future

Technical upgrades and cultural innovations continued to shape Bitcoin’s capabilities and uses. The Taproot upgrade and the emergence of Ordinals are examples of protocol-level and ecosystem developments that arrived alongside growing institutional participation. Across market cycles and regulatory shifts, the network kept operating with lifetime uptime near 99.99%, a benchmark often cited when comparing Bitcoin to core internet infrastructure.

Further reading

For a closer look at how early holdings transformed in value, see early Bitcoin gains, which illustrates individual trajectories from the protocol’s first decade. For perspectives on Bitcoin’s role in global finance, read Bitcoin as a reserve, discussing broader institutional viewpoints.

Почему это важно

Для майнера в России знание ключевых этапов Bitcoin помогает понять, почему сеть остаётся рабочей несмотря на внешние шоки. Высокая доступность блокчейна и повторяющиеся технологические улучшения означают, что базовый протокол продолжает выполнять свою функцию независимо от рыночных колебаний и проблем у централизованных сервисов. Это снижает технологические риски для тех, кто поддерживает сеть оборудованием и электричеством.

Что делать?

Майнеру с 1–1000 устройствами полезно сосредоточиться на простых, практичных шагах, которые не требуют прогнозов рынка и не зависят от чужих обещаний. Следующие рекомендации помогут сохранить операционную устойчивость и снизить неформальные риски.

- Обновляйте программное обеспечение узлов и майнеров по мере выхода проверенных релизов, чтобы поддерживать совместимость с сетью.

- Делайте резервные копии ключей и управляйте доступом к кошелькам: разделяйте хранение и используйте проверенные методы холодного хранения для крупных средств.

- Оценивайте доходность и затраты на электроэнергию регулярно, чтобы выявлять неэффективные площадки или оборудование и вовремя оптимизировать конфигурацию.

- Выбирайте надёжные пуловые или кастодиальные решения с прозрачной политикой выплат и рисками, если не держите собственное управление всеми узлами.

- Следите за новостями протокола и регуляторными изменениями, которые могут повлиять на доступность сервисов или инфраструктуры.

Эти шаги не гарантируют прибыли, но помогают минимизировать операционные и кадровые риски, сохраняя возможность участвовать в сети, которая за 17 лет доказала свою устойчивость.