Tom Lee is a prominent figure in cryptocurrency market analysis, recognized for his expertise and influence on investment strategies. His insights often shape how investors approach digital assets like Bitcoin and Ethereum.

Who is Tom Lee?

With a strong background in financial analysis focused on cryptocurrencies, Tom Lee has become a trusted voice for many investors. His assessments of market trends and price movements provide valuable guidance for those navigating the volatile crypto landscape.

Tom Lee's View on Bitcoin and Ethereum

Tom Lee recommends buying Bitcoin and Ethereum during price dips, viewing these moments as strategic opportunities. He bases this advice on current market conditions that suggest potential for price recovery and growth, encouraging investors to capitalize on temporary declines.

Understanding Buying Dips in Cryptocurrency

Buying dips refers to the practice of purchasing assets when their prices have dropped temporarily. In the context of Bitcoin and Ethereum, this means acquiring these cryptocurrencies during short-term price decreases with the expectation that their value will rise again over time. See also: Crypto Liquidations Reach $394.5M: Bitcoin and Ethereum Lead Losses

Implications for Investors

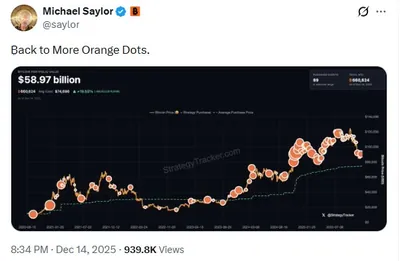

Following Tom Lee's advice to buy during dips can offer potential benefits, such as acquiring assets at lower prices and positioning for future gains. However, investors should also be aware of the risks involved, including the possibility that prices may continue to fall or remain volatile, which could impact returns. See also: Michael Saylor Hints at Next Bitcoin Buy as BTC Drops Below $88,000

Why This Matters

For miners and investors in Russia managing up to 1000 devices, understanding Tom Lee's perspective helps in making informed decisions about when to increase holdings of Bitcoin and Ethereum. Recognizing dips as buying opportunities can optimize investment timing, but caution is necessary due to market unpredictability.

What Should You Do?

- Monitor Bitcoin and Ethereum price movements closely to identify potential dips.

- Assess your risk tolerance before buying during price declines.

- Consider diversifying investments to manage exposure.

- Stay informed about market trends and expert analyses like Tom Lee's to guide your strategy.