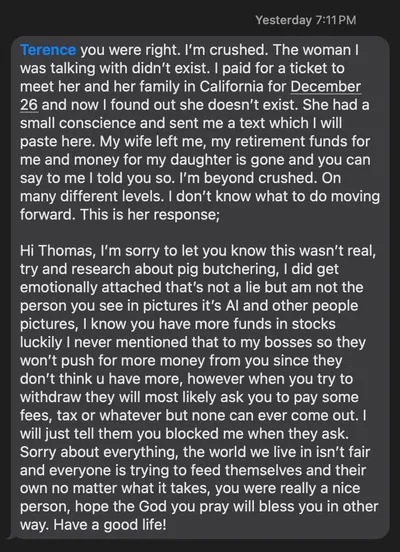

The U.S. Securities and Exchange Commission (SEC) issued an investor alert on December 22 warning that scammers are actively using group chats to promote fake cryptocurrency offers. The alert notes that fraudsters may impersonate well-known experts or create entirely fake identities, sometimes using artificial intelligence tools including deepfake videos, to convince people to join chats and follow investment advice. Victims are typically redirected to websites or mobile apps that look professional, where fake balances and staged screenshots are shown, followed by demands for additional payments when attempting to withdraw funds.

SEC Warning About Cryptocurrency Chat Scams

In the investor alert, the SEC explains that crypto-focused group chats are often used to lure retail investors into fraudulent schemes. Scammers may advertise these chats through social media ads or send unsolicited invitations, making discussions appear visible and authoritative. At the same time, fraudsters often pose as financial gurus, professors, or company executives to gain participants' trust.

How Fraud Schemes Work in Group Chats

The first step is creating a fake investment chat that appears to be a community offering trading or token offering recommendations. After attracting members, scammers may use fake profiles and even deepfake videos to validate their "expertise" and promote supposedly profitable strategies. Victims are then directed to professional-looking websites or apps displaying fictitious balances and false claims of regulatory approval; when attempting to withdraw funds, owners are asked to pay nonexistent fees.

Fraud Signs Highlighted by the SEC

- Guaranteed or "risk-free" returns promising steady profits without losses.

- Fake claims of regulation or licenses, including references to fictitious regulatory approvals.

- Requests to send cryptocurrency to unknown wallets or third parties.

- Professional-looking websites and mobile apps with staged screenshots and fake account balances.

Legitimate Activity in Cryptocurrency

The SEC emphasizes that legitimate crypto activity continues and operates within existing securities laws. Reliable operations usually feature transparent blockchain records and verifiable transactions, and legitimate intermediaries operate within legal frameworks. Regulated platforms and intermediaries help maintain lawful innovation and investor participation while complying with requirements.

Why This Matters

Even if you engage in mining and do not plan to trade actively, scam schemes in chats can affect any crypto community—from seeking exchange advice to profit placement offers. Scammers target retail participants, including those earning income from mining, and exploit trust in closed groups to direct people to fake platforms. Understanding scam mechanisms helps avoid financial losses and emotional decisions when managing cryptocurrency.

What To Do?

- Do not trust unsolicited invitations or take advice from closed chats at face value—verify the identities of hosts and their public activity records.

- Do not send cryptocurrency to unknown wallets or transfer funds based on chat instructions without independent verification.

- Be skeptical of guaranteed income promises and verify any regulatory license information directly on regulator websites.

- Before registering on a new platform, check the URL, official information, and reviews outside the chat; avoid clicking links from messages without verification.

- If withdrawal attempts require additional "fees" or penalties, pause operations and clarify the origin of the request—this is a common scam tactic.

The SEC also cited the Morocoin case, where platforms and investment clubs were accused of attracting investors via social media and group chats. Maintaining caution, verifying sources, and using regulated services can help reduce risks when dealing with cryptocurrency.