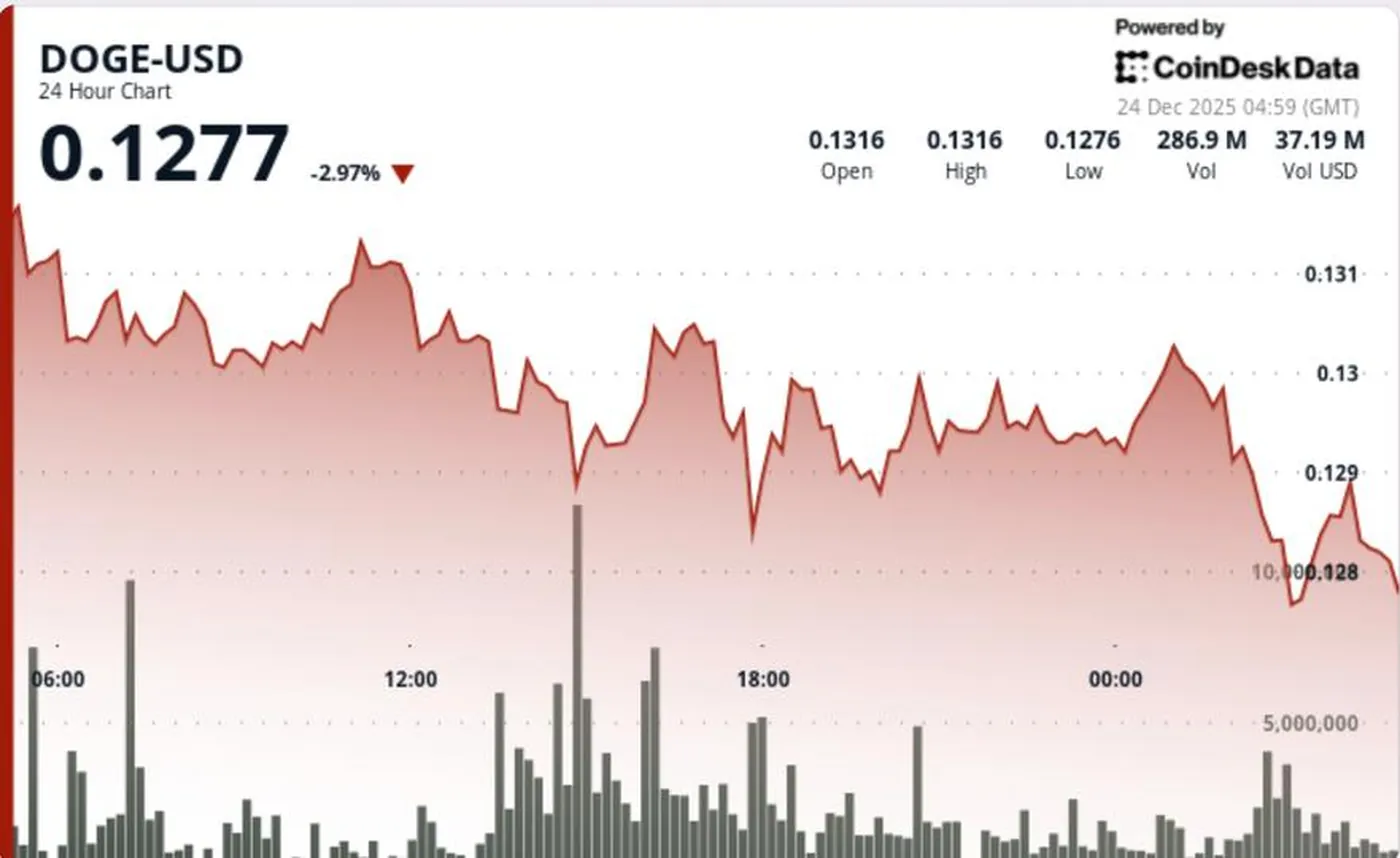

Dogecoin fell below the $0.13 level on Tuesday amid heavy spot selling coinciding with a sharp rise in derivatives activity. BitMEX reported a surge in DOGE futures volume—a 53,000% increase to $260 million—indicating traders are ramping up volatility bets. The key breakout confirmation came at 16:00 on December 23, when session volume reached 639 million tokens, roughly 101% above the average.

Causes of Dogecoin's Decline

The main cause of the brief drop was the combination of two factors: strong spot market selling alongside simultaneous buildup of derivatives positions. This combination amplifies the impact of stops and liquidity around key round support levels, particularly the $0.13 mark. As a result, the meme coin became more sensitive to shifts in participant positioning.

Derivatives Market Analysis

The sharp increase in BitMEX futures volume shows traders are increasingly using DOGE to bet on wide price swings. At the same time, this raises the likelihood that price moves will be fueled by position squeezes and rapid liquidity drains rather than calm recoveries. Comparing futures activity with spot trading volumes helps better understand the main source of selling pressure.

Technical Analysis

Technically, DOGE broke below $0.1300 after sellers intensified pressure during U.S. trading hours; the key confirmation occurred at 16:00 on December 23, when volume reached 639 million tokens. Intraday selling accelerated from about 01:41, with price passing through intermediate support levels at $0.1295 and $0.1292. The current structure resembles a descending channel: the coin trades below short-term moving averages, which typically limits rally strength until the broken level is reclaimed.

Price Dynamics

Over the past 24 hours, DOGE fell 2.3%, dropping from $0.1323 to $0.1292, while the intraday range expanded to $0.0047 (approximately 3.6%), reflecting increased volatility. Price stabilized near $0.1290 toward the session’s end as volumes cooled off from peak levels. These figures indicate the market experienced a rapid sell-off with amplified price swings.

What Traders Should Know

The key level to watch is $0.13: a return and hold above this level would restore it as support, while a failure would increase pressure toward the next demand cluster around $0.1285–$0.1280. High futures volumes point to participants’ readiness for sharp swings, so moves may be both swift and deep. When trading, it’s important to consider DOGE’s increased sensitivity to liquidity and positioning.

Why It Matters

For miners with small equipment pools, the impact may be indirect but noticeable: increased volatility makes trading income more sensitive to the timing of converting mined coins into rubles. If you hold part of your mining output in DOGE or use it to cover expenses, sharp price moves and differing spot and futures behavior can affect your operational profitability. Understanding current volume structures and support levels helps make more informed hold-or-sell decisions.

What to Do?

- Assess what portion of your mined coins you hold in DOGE and set target levels for converting to rubles considering higher volatility.

- Monitor volumes: sharp spikes in futures and spot often precede strong moves and increased slippage on order execution.

- Establish clear risk management rules—such as limits on capital share in a single meme coin and strict stop-loss criteria to avoid cascade liquidations.

- Regularly compare current conditions with technical levels ($0.13, $0.1295, $0.1292, $0.1285–$0.1280) and adjust behavior as liquidity changes.

For details on specific price moves, see the materials on the recent support breakout, and for spot volume assessment, refer to the publication on spot trading volumes. Data source: market report and BitMEX publication.