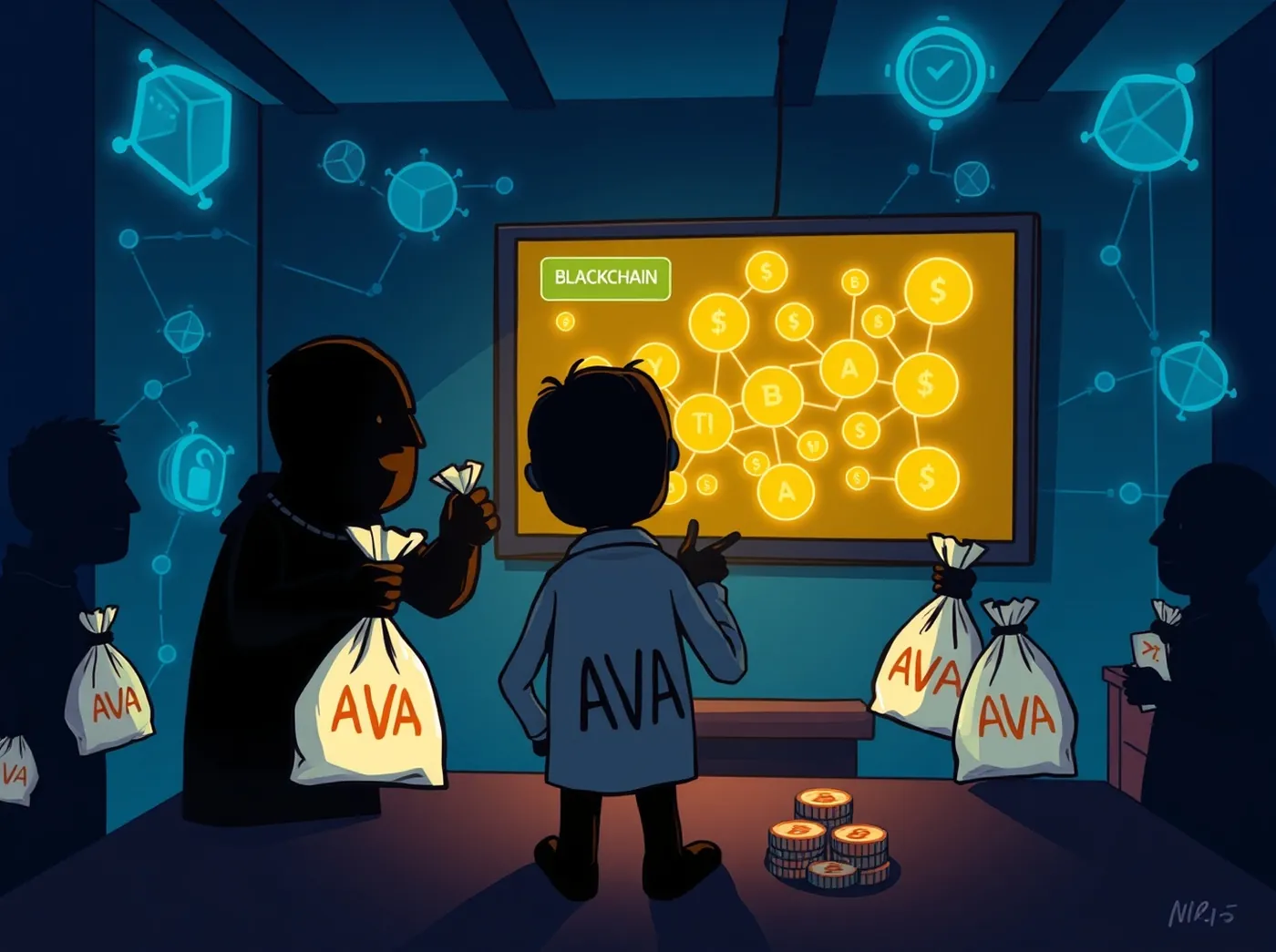

On-chain analytics firm Bubblemaps has flagged apparent organized insider activity involving the Solana-based token AVA. According to the analysis shared with Cointelegraph, Bubblemaps says 23 wallets linked to the AVA issuer acquired roughly 40% of the token’s total supply immediately after launch, and additional wallets connected to those buyers also purchased during the early release.

Key finding: Bubblemaps’ allegation

Bubblemaps’ core claim is that a small group of wallets captured a large share of AVA right after the token went live. The firm identified 23 wallets directly tied to the issuer that together bought about 40% of the supply, which the report frames as nearly half of available tokens falling under apparent control early on.

How Bubblemaps’ analysis was described

The detailed analysis was shared with Cointelegraph and, per the report, shows rapid, coordinated accumulation in the first moments after launch rather than a slow, independent build-up. Bubblemaps also noted that additional wallets associated with the initial buyers made purchases during the early stages, a pattern the firm says suggests coordinated collusion.

AVA price timeline and market impact

The market moved sharply after launch: AVA reached a peak price of $0.33 on January 15 and has since fallen by approximately 96% to $0.01059. This steep decline is presented in the report alongside the concentration findings to raise questions about whether early price action reflected broader market demand or activity by large holders.

Why this matters

For miners and small operators, concentrated token holdings can translate into outsized influence over price and liquidity, which increases the risk that a token’s market can move sharply and unpredictably. When a small group controls a significant portion of supply, it can affect how easily you can sell without moving the price, and it raises the chance that early gains may not reflect organic demand.

At the same time, the original Cointelegraph report did not include statements from the AVA team, and there has been no widely publicized official response to the Bubblemaps findings, which leaves open questions about disclosure and governance for affected projects. Remember that the page carrying this report includes a disclaimer that the information is not trading advice and that Bitcoinworld.co.in holds no liability for investment decisions.

What to do?

If you run from a single device up to a small farm, take practical, low-effort steps to reduce exposure to launches like AVA. First, check token distribution charts and on-chain visualizations before buying; tools like Bubblemaps help reveal wallet connections and concentration patterns that are not obvious from price alone.

Second, include simple due diligence in your routine: review the project team and token distribution, look for independent audits, and avoid buying into a token immediately at launch if large holders appear to dominate allocations. For broader protection, keep positions diversified so one problematic launch does not represent a large share of your capital.

For those interested in on-chain movement and distributions in other contexts, see reports on token distributions and Solana investments such as distribution to holders and broader Solana investments, which may help you compare patterns across projects.

Context and next steps

The Bubblemaps case is presented as an example of transparency and disclosure challenges in crypto launches, and the article suggests it could increase demand for clearer disclosures, audits and investor protections. While the report attributes its findings to on-chain analysis, it refrains from asserting proven wrongdoing and instead frames the evidence as raising questions about market fairness.

Finally, note the site disclaimer: the information provided is not trading advice and Bitcoinworld.co.in holds no liability for investments made based on this page. Perform your own research or consult a professional before making decisions.