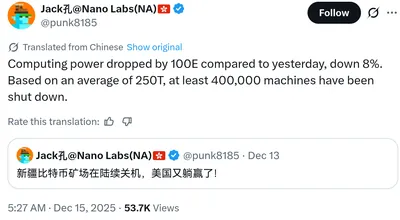

In December 2025, the Bitcoin network's hashrate sharply dropped by about 10% in just one day. According to former Canaan co-chairman Jianping Kong, this was due to the mass shutdown of mining farms in the Xinjiang autonomous region in western China. An estimated 400,000 mining machines were halted, causing the hashrate to fall from 1,053 TH/s to just under 943 TH/s.

Causes of Bitcoin Hashrate Drop in December 2025

The main reason for the sharp decrease in the network's computing power was the closure of large mining farms in Xinjiang. Kong estimates that shutting down about 400,000 ASIC devices led to a reduction in hashrate by roughly 100–110 TH/s in a single day. This is confirmed by YCharts statistics, which recorded a drop from 1,053 to 943 TH/s. Although exact hashrate values are always estimates, the scale of the change highlights the significant influence of Chinese miners on the network.

Kong's comments emphasize that the closure of mining operations in China opens more opportunities for the US, which is strengthening its position in the industry. Additional analysis of the reasons behind the drop can be found in the article Why Did Bitcoin's Hashrate Drop Sharply in December 2025?.

China's Role in Bitcoin Mining

Until 2021, China led global Bitcoin mining, accounting for about 65% of the world's hashrate. However, after the mining ban in 2021, the country's share dropped sharply. In 2024, despite ongoing restrictions, China regained a 14–20% share of global hashrate thanks to cheap electricity and covert operations.

Many miners continue to operate in China despite official bans, creating instability and risks for the entire network. For more details on trends in China, read the article Reasons for the Surge in Bitcoin Mining Activity in China in 2025.

Growth of Bitcoin Mining in the US

As China's share in mining declines, the US is actively developing its own infrastructure. Hut 8 has announced the construction of four new mining sites in Texas, Louisiana, and Illinois, with a total capacity of 1.5 GW. Hut 8 owns American Bitcoin—a company linked to the Trump family, with Eric Trump on its board of directors.

The US is becoming an increasingly attractive jurisdiction for mining amid restrictions in China and political support for the industry.

Investigations and Restrictions in the US Against Chinese Companies

US authorities are tightening control over mining equipment imports from China. In 2024, Bitmain—one of the largest ASIC manufacturers—became the subject of a national security investigation. As a result, thousands of ASICs were held at customs, with their release only starting in March of the following year.

Additionally, the activities of Xiamen Sophgo, a company linked to Huawei (which is under US sanctions), are also under investigation. These measures affect American companies that cooperate with Chinese equipment manufacturers.

Why This Matters

For Russian miners, developments in China and the US directly impact equipment availability, hashrate costs, and the stability of the Bitcoin network. A drop in hashrate may temporarily make mining easier, but it also increases the risks of centralization and dependence on specific regions. Stricter controls on ASIC shipments and political investigations can lead to delays and higher equipment prices.

What Should You Do?

- Monitor changes in the global mining landscape and be aware of potential equipment supply disruptions.

- Assess risks associated with dependence on Chinese ASIC manufacturers.

- Consider alternative markets for equipment procurement and diversify suppliers.

- Plan operations with possible changes in network difficulty and hashrate fluctuations in mind.